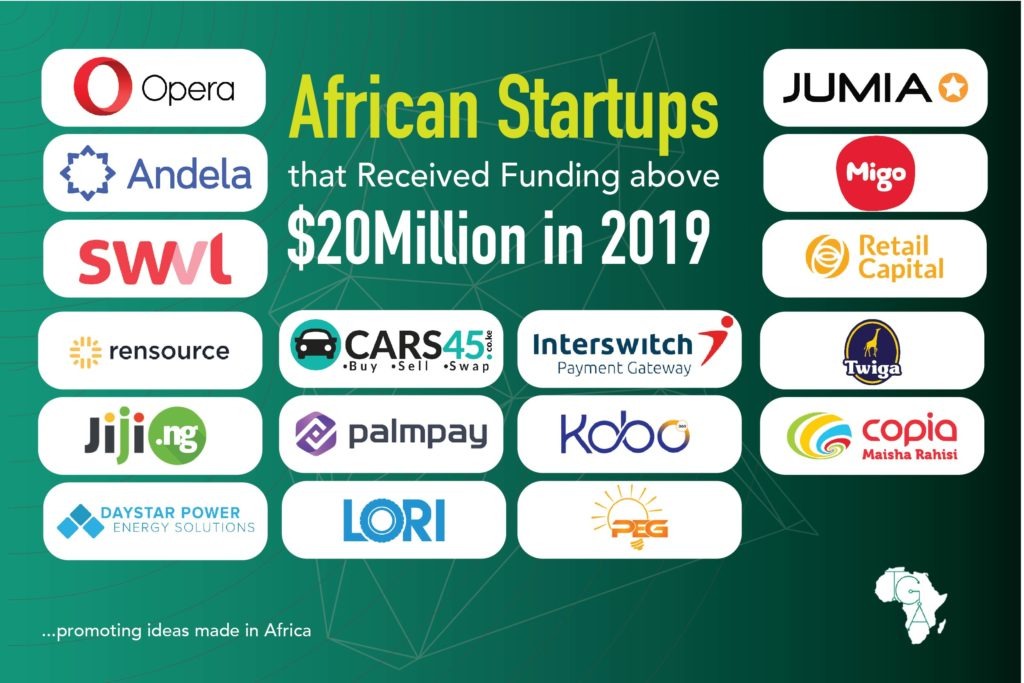

Capital is the power nerve and brain box of every venture. It determines the lifespan of the venture and helps the business scale its market power to compete favorably with other startups in the market. In this piece, we take a cursory look at African startups that got the most funds from top deals in 2019.

First, OPay. OPay rose high on the funding table this year with a total of $170million in its series B funding round. The fund was raised in two consecutive rounds. The first was a $50 million funding round in July followed by its Series B funding of $120million in November. The fund has since been put into offering various services like OTrike, OCar, OCash, OWealth and positioning the Opay app as the one stop shop for finance and lifestyle in Nigeria.

Breaking the funding box in the third quarter of 2019 was Cars45. The startup got a whopping $400 million from OLX Group. The fund will make the online marketplace for cars compete favourably beyond the Nigerian market. The venture will also be positioned to manage all OLX businesses in Africa; expanding its reach in the online market spaces in Africa.

Interswitch followed closely in this category by raising $200 million in its deal with Visa. The company also plans to list an IPO on both the Nigerian and London Stock exchange in the coming year. This will place the company’s value at $1billion, making it one of Africa’s few tech unicorns.

Meanwhile, in the early hours of January, the software engineer and training organization, Andela secured $100 million in a Series D round. Andela’s plan includes hiring 700 experienced Software Engineers by 2020 to meet its business needs and improving the large pool of engineering talent that could prove to be a lucrative means of empowering people and improving our human capital export as a continent.

eCommerce giants, Jumia, also raised $56 million funding from the sales of its private stocks to MasterCard. The funding was part of the pre-stock sales and ahead of its million-dollar IPO listing on the NewYork Stock Exchange.

Egyptian based ride-hailing startup, Swvl, also made the list by raising $42 million at the end of Q2 2019. This is part of its series B funding which places the company’s value at $100 million.

Next, we have the South African investment startup, Retail Capital. Retail Capital offers flexible repayment investments to startups in South Africa. The startup got $41.7 million in funds in the first quarter of 2019. The fund has thus been used to scale various Small and Medium Business (SMEs) in South Africa.

Whilst some may argue that PalmPay is not an African startup, but the company’s major focus is on the Africa continent. Therefore, it is important to note their capital-raising strides. The fintech startup raised $40million from the Chinese phone maker company, Transsion. The funds would be used to expand its services across African cities.

Also on the list is Ghanaian-based PEG Africa raised $30 million in two rounds. First, it raised an initial $25 million series C funding in March and additional $5million debt financing in September. PEG Africa is a Pay-As-You-Go solar company that has its base in Ghana and the funds will be used to expand its growth in Africa beginning with Senegal.

Kobo360 got a lead on its $1.3 trillion intra-Africa trade opportunity with a $30 million funding in a series round. This venture funding round was led by Goldman Sachs, with participation from Asia Africa Investment, Consulting Pte and existing investors like TLcom Capital, Y Combinator, the International Finance Corporation and Nigerian commercial banks.

Lori Systems, a logistics startup that operates in both East and West Africa also received $30 million in funds from a Series round. The fund was led by Crystal Stream Capital and Hillhouse Capital Group.

Twiga continues to thrive in their efforts to democratize food distribution in East Africa. The Kenyan-based B2B distribution company raised $30 million funds in the year in view. The funding was part of its Series B round and was gotten through a $6.25 million debt funding and $23.75 million Equity funding.

Startups in the energy sector like Daystar Power Energy Solution also had some nudge to its running cost. The startup raises $26 million from an initial $10 million investment and an additional $16 million in debt financing.

Meanwhile, the Pan-African Digital Marketplace, Jiji also raised $21 million as part of its Series C funding that was led by Knuru Capital. The e-commerce platform offers thousands of buyers and sellers access to exchange goods and services. The $21 million raised will be used to penetrate the 5 markets it currently occupies and upgrade its platform to accommodate more product listings. It will also create an improved platform where buyers and sellers in the real-estate sector can be matched.

Nigeria based fintech Mine.io now known as Migo raised $20million over two rounds in 2019. The funds came as an investment from Valour Group in its Series B round. Also participating are Velocity Capital, Western Technology Investments, First Ally Capital, X/Seed Capital, NYCA Partners, Persistent Capital, Singularity Investments, Trans Sahara Investments and the Bank of Industry. Mines provides a Credit-as-a-Service digital platform that enables institutions in emerging markets to offer credit products to their customers, with no smartphones required.

In Kenya, the eCommerce platform Copia raised $28 million. The fund came in two investment series: First was an initial $2 million investment received in January from Goodwell and an additional $26 million fund in the Series B round. Copia has proceeded to open a warehouse in Tatu City and launched Copia Online, an e-commerce platform that will enable customers to purchase goods online for relatives and friends in rural Kenya.

Rensource joined the $20 million gang in the last 15 days to the end of the year. The fund was raised in its Series A funding that was led by CRE Venture Capital and the Omidyar Network. Inspired Evolution, Proparco, EDPR, I&P, Sin Capital and Yuzura Honda also participated in the funding round. The funds will enable the energy company to grow its technology offerings and expand across Nigeria and Africa.

Other significant funding rounds in 2019 were raised by Some of these startups include MaxNG, BitPesa, FairMoney, Gokada and TymeBank. Sector-specific research shows the fintech sector remained the most popular among investors, attracting the highest pool of funds raised on the continent. Other spaces, such as e-health, transport and logistics are garnering ever-more attention and funding.

Africa continues to attract the attention of investors from across the world who focus on

Technology startups. This serves as a validation for so many of the solutions developed on the continent and it also catalyzes the growth potential for Africa considering the size of the market and the unique socio-economic challenges that can be solved with the aid of technology. This new year 2020 promises to be even more exciting for technology in Africa. We’re here for all of the gists!