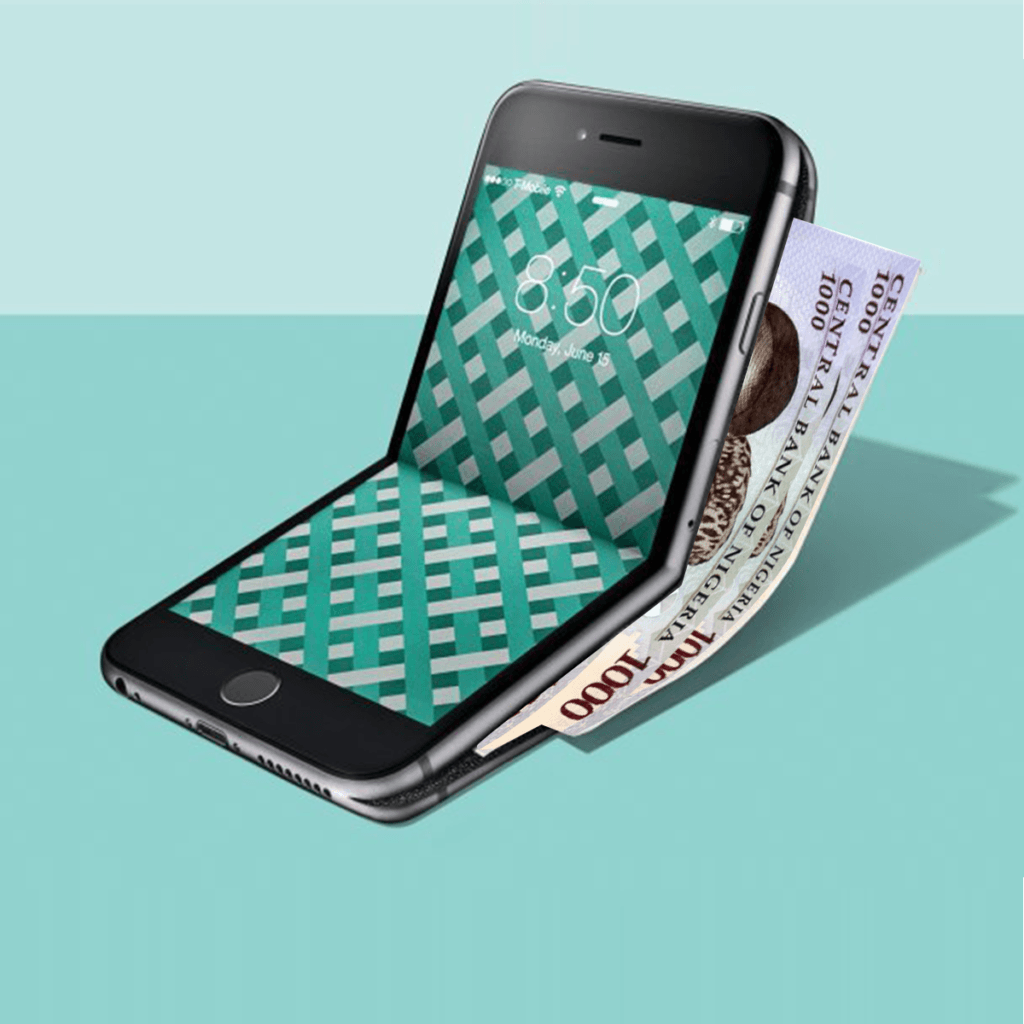

The Central Bank of Nigeria has given all banks in Nigeria full authority to operate mobile money wallet services without prior approval. This message was passed to the banks through a circular issued by the CBN.

The circular, titled ‘Operation of mobile money wallets by DMBs’ reads;

“The Central Bank of Nigeria remains committed to deepening financial inclusion in line with its objectives to achieve the national financial inclusion target of 80% by 2020.

To complement recent growth in the agent banking services under the Super Agent and SANEF initiative, and in recognition of the increasing demand for no-frills mobile money services, the CBN hereby directs that Deposit Money Banks shall henceforth not require prior approval to offer mobile money wallet services.

DMBs are, however, expected to notify the CBN before the commencement of these services and are required to operate within the extant regulations on mobile money operations.”

See also: Nigeria’s Kudimoney obtains Microfinance Bank License, changes Brand Identity to Kuda

This directive of the CBN is a means to boost agent banking services and make it align with the Super Agent Network Expansion Facility (SANEF) initiative. This backing by the CBN will give commercial banks the advantage of meeting customers demand without unnecessary services that will cost more.

The Mobile Money Service simply refers to an electronic wallet service. It was created in Nigeria in 2012 in a bid to carry out the CBN’s cashless policy. Through the mobile money service, consumers can save, send or receive money through their mobile phones.

This new development will allow the CBN to reach their goal to financially include 80% of the population by 2020.

More on TechGist Africa:

- Celebrating Forbes African 30 Under 30 Tech Heroes 1

- Unicorn Group to fund African Tech Ecosystem with $300 Million

- Econet Shuts down Video Streaming Service Kwesè Play

- Applications are Open for GreenHouse Lab – Nigeria’s First Female-focused Tech Accelerator

- NITDA Issues Nigerian Government Officials Ultimatum Over Use of Social Media Regulations