WHAT’S ALL THE HYPE ABOUT MASTERPASS QR?

What is Masterpass QR? It is the brainchild of a collaboration between Africa-based merchant service provider Kopo Kopo and worldwide finance company, Mastercard. More specifically, Masterpass QR is a mobile payment solution targeted at micro small and medium enterprises (MSMEs) across 11 markets in Sub-Saharan Africa. The service is set to reach 250,000 MSMEs in the next five years. Read further to find out more about this service.

The product was first announced in Nairobi, Kenya at the Financial Times Africa Payments Innovation Summit. Kopo Kopo is a Kenyan company that provides the value-added services that stimulate activity in a merchant ecosystem. This is necessary because many merchants in Africa do not participate in formal banking within the continent. Banks who are acquiring the service will enable merchants to also be integrated into the system in each of the markets Masterpass QR tends to enter. The initial launch in Kenya has allowed merchants (business owners) to integrate with Diamond Trust Bank. Additional markets impacted will include: Tanzania, Uganda, Ghana, and Zimbabwe.

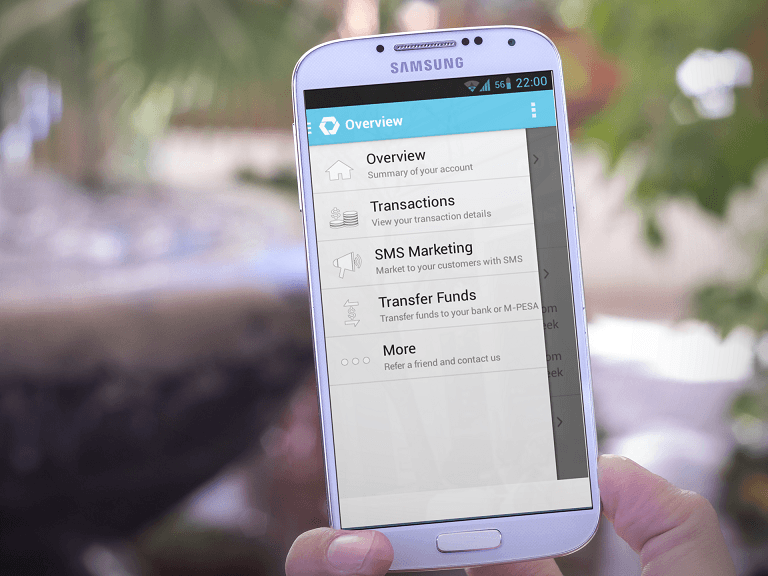

How exactly does Masterpass QR work though? Any small business that wants to allow customers to make digital payments, registers for Masterpass QR with their local bank and receives a decal with a unique business ID on which a QR (quick response) code is found. The business then displays this sign in their office. Customers can simply scan the QR code to make a payment; allowing customers to pay for goods and services directly from their smartphones.

A customer using Masterpass QR simply downloads the Masterpass QR application on his or her smartphone, scans the merchant’s QR code displayed at point-of-sale, enters the transaction amount and initiates payment. The customer confirms the transaction using a PIN and receives instant confirmation of the transfer.

So, with just a simple QR code, business owners can increase revenue by making it possible for them to receive payments via mobile and digital avenues. Moreover, no additional infrastructure is required to make these transfers possible.

Will this idea be able to penetrate the Sub-Saharan African market? Share your views with us in the comments below.

Source: Biztech