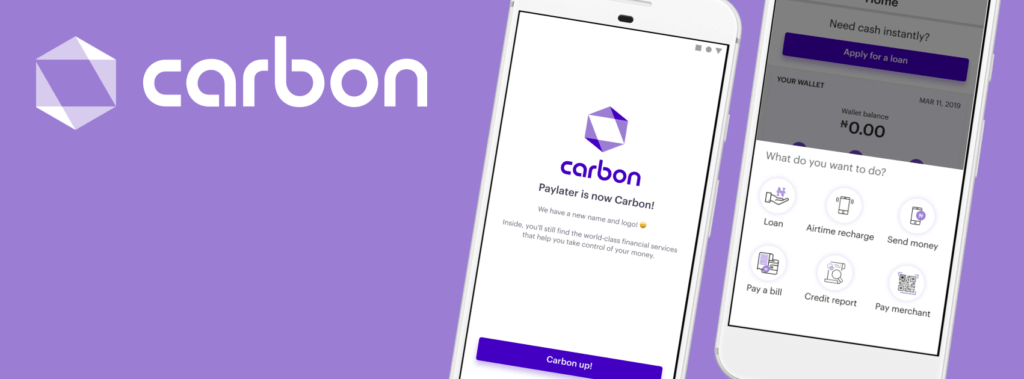

Paylater, Nigeria’s pioneering consumer lending firm has rebranded as “Carbon” in its deliberate transition to a fully-fledged digital financial services platform.

Last month, Paylater unveiled plans to rebrand. It recently secured a $5million investment from Lendable to deploy more loans to its customers and expand its markets. This was followed by an acquisition of payments company Amplify, reinforcing its move into multiple strands of financial services.

Launched in 2016, Paylater is a digital finance management platform that provides instant loans, payments and investments without providing a guarantor, collateral or application fees. Carbon will now offer bill payments, fund transfers, and savings products, in addition to loans. The firm also introduced brand new products such as free credit reports and a wallet for its customers to perform discounted transactions.

“It was very deliberate – most of our customers only know us as Paylater which conjures up images of credit, but we have grown as a company to offer so much more,” says Chijioke Dozie, CEO and Co-founder.

See also: SA’s Fintech Startup, Invoiceworx Rebrands to Zande Africa

“Carbon is one of the most essential elements for human life, it is found in all life forms and is extremely versatile. So to us, Carbon represents our aspiration to go everywhere with our customers, become an essential part of their lives and be versatile enough to change or innovate to fulfill their needs. We know what our customers’ pain points and needs are when it comes to banking in Africa and we are building financial products around them,” added Dozie.

Co-Founder Ngozi Dozie added: “We’re in a competitive space but whoever serves the customer best will reap the rewards. That’s been the thinking behind our product evolution, whether it’s our Bloom account targeted at female entrepreneurs or the partnerships we’ve been working on in the healthcare sector. The focus is on being attentive to what our customers want and need”.

Carbon is also looking to unveil new innovative products such as credit via QR codes (in partnership with Visa). It is working hard to provide additional features such as health plans, accident and life insurance for its customers to lessen the burdens Nigerians currently carry in accessing and paying for it.

The platform would now be offering bill payments, airtime purchases, free credit reports and a wallet for its customers. It will also be offering in-app credit reports and financial management for its customers, beyond its traditional money lending. The updated Carbon mobile app is now available to download on the Google Play Store.