The Reserve Bank of Zimbabwe (RBZ) has instructed fintech operators to disclose the geolocation of their access points in Zimbabwe. It also released a set of additional consumer protection guidelines for payment service providers.

RBZ directed financial services providers to disclose the geolocation of access points and devices such as Point of Sale (POS), mobile money agents, merchants, branches, and ATM stands within the country. The geolocation of access points and devices will be openly available to interested stakeholders.

See Also: REDAVIA Launches Modular Solar Carport in Africa

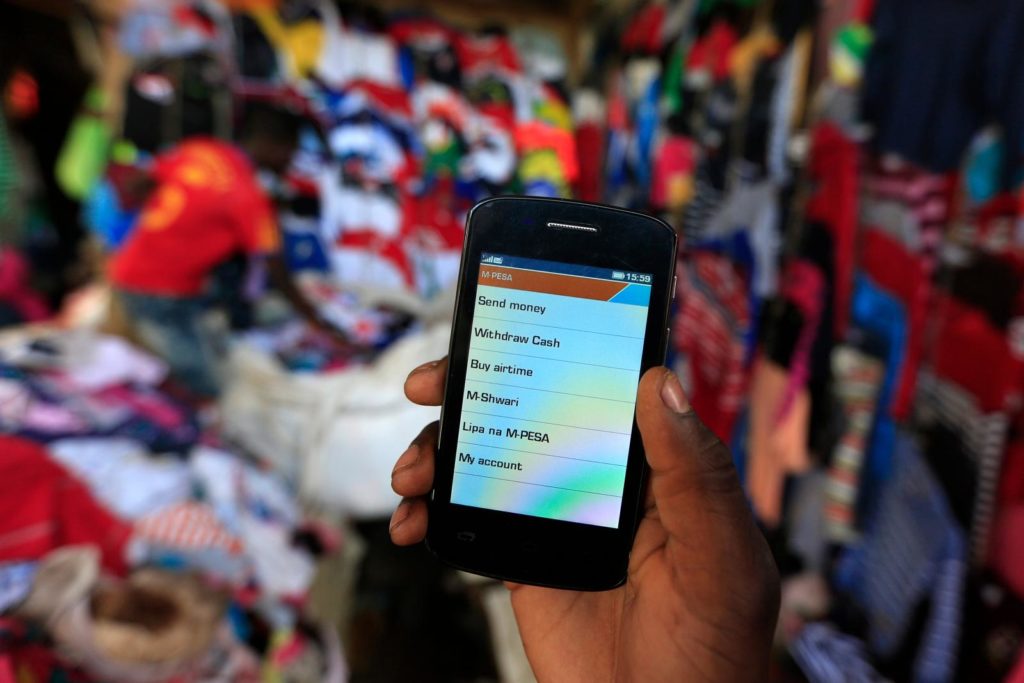

The continuing cash scarcity in Zimbabwe has made people resort to mobile money services. RBZ seeks to increase the number of mobile money agents because the economy has become reliant upon digital payment. There are over 5 million mobile money transactions worth over $200 million carried out daily in Zimbabwe.

RBZ expects every fintech to submit identification and publication of their exact locations in Zimbabwe. The data will help it set up a mechanism for handling complaints relating to electronic payment.

Several banks in Zimbabwe are reinforcing the deployment of POS machines, mobile money agents, and services. RBZ also instructed fintechs to update and provide stakeholders with information on their websites and other electronic platforms.