InTouch is a Fintech startup that launched back in 2014. The Senegal-based startup has taken an unusual approach by spreading its business across different countries across the continent of Africa.

With the partnership of Total and Worldline, the company has spread its reaches across eight total African countries so far, including Cameroon, Burkina Faso, Ivory Coast, Kenya, and Morocco.

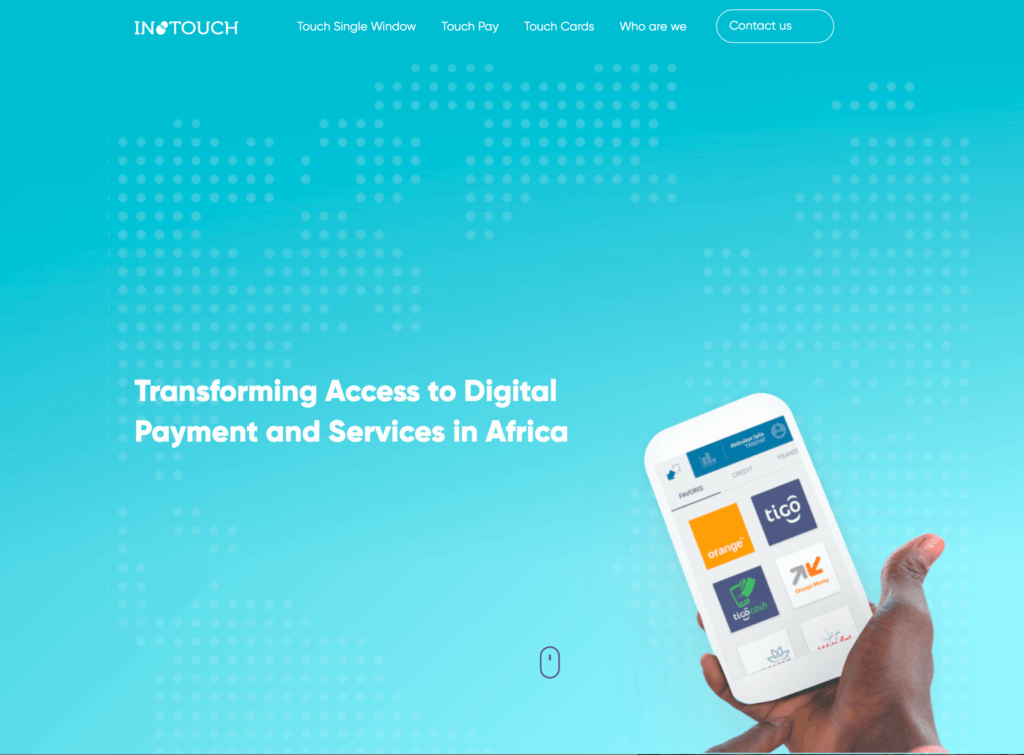

The startup provides an excellent universal solution called Touch which allows vendors to accept all forms of payment. Vendors can also offer digital services using a single device and only one account.

Omar Cissé, the founder of In Touch, said that the unusual expansion across Africa was inspired by its significant success in Senegal. In July 2017 alone, the startup reached 650,000 transactions with a total volume of more than $20 million USD.

He said, “More than 800 merchants have adopted our solution – all 170 Total gas stations in Senegal, and 700 other independent points of service, mainly in Dakar. We have deployed 1,500 devices, and have more than 160,000 clients enrolled in our loyalty programs.”

Within the next 12 months, the company plans on expanding out to 8 African countries. By the year 2021, the startup hopes to have expanded to at least 38 countries.

The company now has a team of more than 70 employees. InTouch has a great number of competitors across Africa including Kenya’s Kopo Kopo and Senegalese PayDunya.

Some of the key selling points that InTouch flaunts appropriately are ease of use, the diversity of its solutions and the opportunities for income diversification. These key factors help it stand out among its competitors.

Its business partners Total and Worldline will help its expansion across Africa through investments.