Recently, it was announced that Visa partnered with PayMate to service corporate customer’s needs to clients in Central and Eastern Europe, Middle East and Africa region. This move follows the two platforms initial launch in India in 2017.

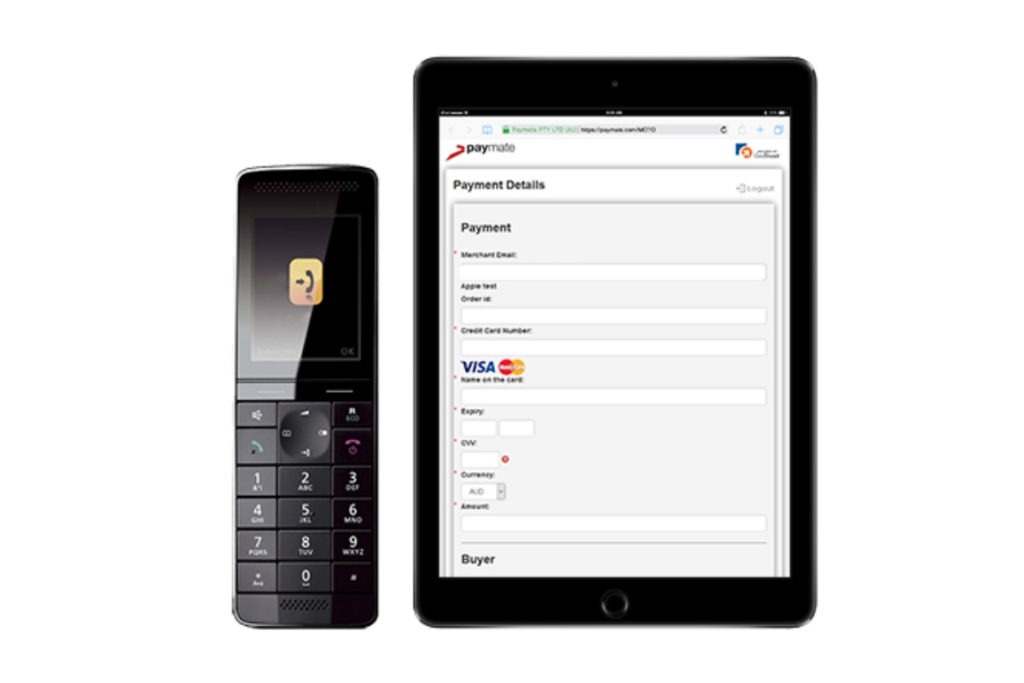

The arrangement will be facilitated through Paymate’s technology. The PayMate’s cloud based platform digitizes procurement-to-payment cycle for businesses and also aids huge enterprises and SMBs to transition from slow and expensive forms of payment to real time and efficient digital mediums. The platform aids vendors automation and will also manage vendor payment, customer payments and invoicing, thereby improving efficiency and transparency of cash flows.

See Also: MultiChoice Tops JSE with $3 Billion on Debut

Rakesh Khanna, Vice President, head of Visa Business Solutions, CEMEA Visa said, “Visa has a significant focus on digitisation of B2B payments and we are teaming up with companies like Paymate to help simplify payables and receivables processes for businesses of all sizes. Our initial foray with Paymate in India resulted in a large number of Enterprises and SMBs making payments using Visa commercial cards across industry verticals, contributing to significant B2B payment volume growth in the country. We are keen to extend this alliance to enable our financial institution clients in CEMEA to streamline the B2B payments process for their corporate customers. At the same time, we are introducing secure, fast and efficient digital payments to the sellers to help optimize their cash flows.”

Ajay Adiseshann, CEO, PayMate added that, “There is an ever-increasing demand for automation and digitization of the entire procurement to payment cycle to help save cost, time and effort. We have a comprehensive payments platform that reduces expenses and time for processing payments, thus helping buyers pay earlier and helping sellers receive payments faster. We are thrilled to expand outside India with Visa and offer our platform to businesses operating in CEMEA region.”