A digital wealth management and financial planning solution, Nigerian startup Cowrywise has raised US$3 million in pre-Series A funding to broaden its product portfolio, facilitate the onboarding of more fund managers, and build up its infrastructure for investment management. Quona Capital, a host of local Nigerian angel investors and in the diaspora participated in the funding round.

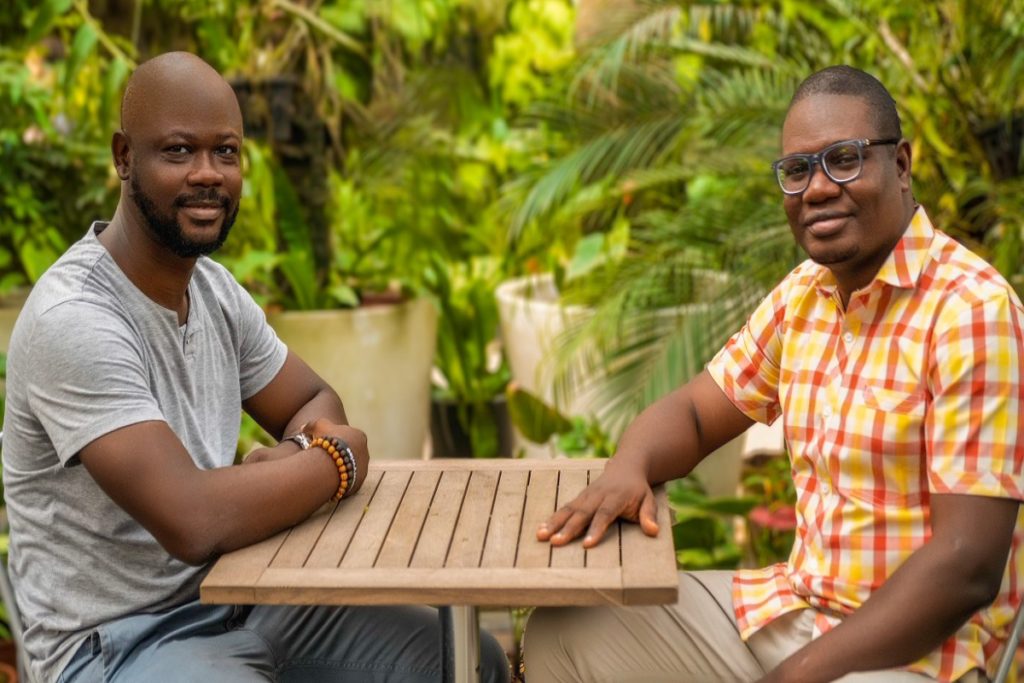

Launched in 2017 by Razaq Ahmed and Edward Popoola, Cowrywise provides more competitive rates than conventional alternatives for easily available, goal-oriented savings and investment products.

Cowrywise’s concept came when CEO Razaq Ahmed was a Meristem investment analyst covering equities and making suggestions to retail and wealth management customers. He found that the top 1 percent was the target of established investment management firms in the world. Because of their limiting size, they could not scale investment products to millions of Nigerians mainly.

Despite historically high levels of digital connection, the majority of Nigerians under the age of 35 have limited access to quality savings and investment products. For Nigerians in particular, the opportunity to save and invest in building wealth is important since they are young and major investments usually require a complete capital commitment in advance, making forward-looking savings and investment products a critical component of achieving financial goals,” said Ahmed, who is the chief executive officer of the startup (CEO).

With about 45 million unique accounts in Nigeria, the start-up currently has 19 distinct mutual funds available via its website, enabling users to start saving and investing with as little as NGN100. The Cowrywise platform leverages internal mechanisms to suggest investment products that meet each consumer’s individualized needs, many of whom have never made an investment before.