Numida, Ugandan fintech company, has closed its $2.3 million seed round.

MFS Africa, a pan-African payments firm, led the seed round. Along with angel investors, DRK Foundation, Equilibria Capital, and Segal Family Foundation took part in the seed round.

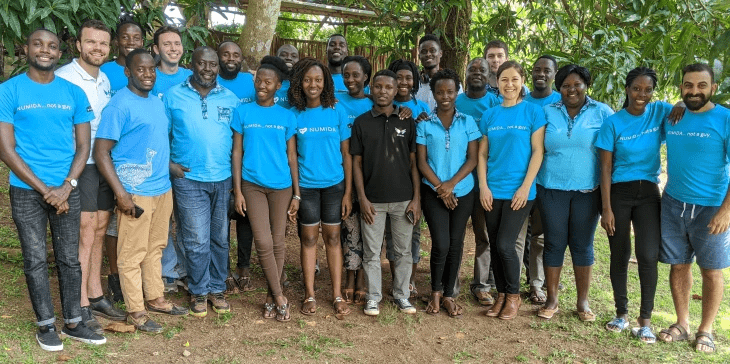

Numida was founded in 2017 by Mina Shahid, Catherine Denis, and Ben Best, who saw an opportunity to create one of East Africa’s first digital fintechs focused on semi-formal micro and small businesses.

Numida provides risk-based pricing on an applicant’s first loan based on a proprietary credit score.

Numida kept its portfolio small from May 2017 and iterated on its underwriting process and credit risk algorithm.

After multiple iterations, the company officially launched in October 2019, with a 6x increase in lending volumes, according to the company’s CEO Mina Shahid.

To date, it has disbursed about $250,000 per month in unsecured credit to 3,000 micro and small businesses in Uganda, totaling more than $2 million.

Shahid explained that this is due to outstanding collections, repayment rates, and customer retention.

Its financing model is based on 15,000 loans that took a long time to complete, and this timing places a limit on how quickly it can onboard and service customers.

The pandemic, on the other hand, has aided in the acceleration of this model, and Numida is poised to expand even further with this new investment.

Numida is aiming to provide loans to up to 22 million African small businesses.

The startup, which has received new funding, is looking to pilot in a new market outside of East Africa, with Ghana being a likely spot.

Customers will be able to use Numida’s additional financial resources, such as payments, microinsurance, and deposits.

Read More on Tech Gist Africa:

Appzone, a Nigerian fintech, has raised $10 million in a Series A round of funding