OKO has received a seed investment of USD$1.2 million from Newfund and ResiliAnce in a funding round.

Mercy Corps Venture, Techstars, ImpactAssets, and RaSa were among the investors in the round.

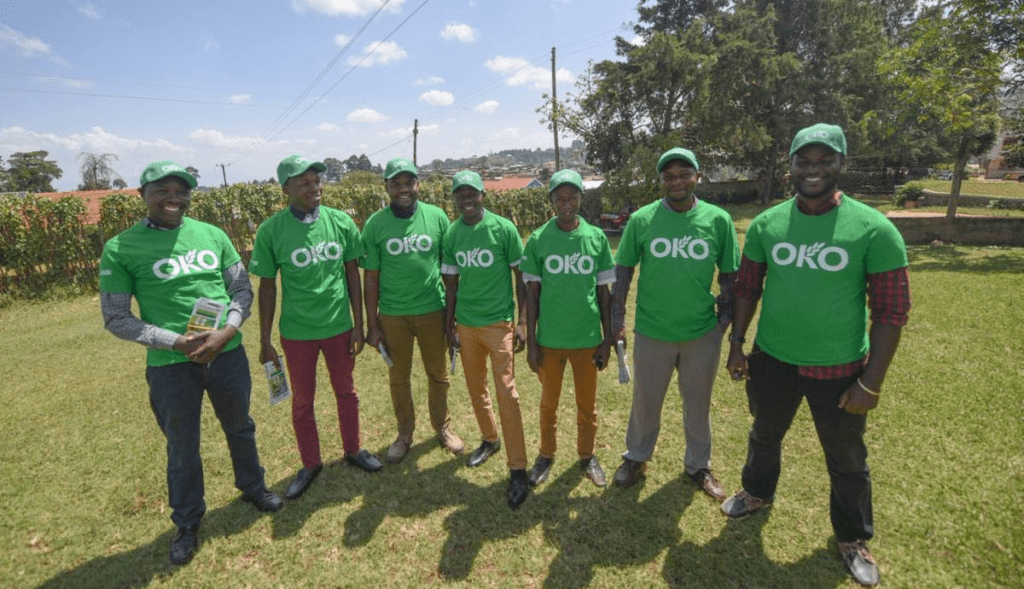

In Mali and Uganda, where they currently work, the Insurtech startup provides inclusive agricultural insurance to protect farmers’ profits.

OKO plans to use the new funds to boost its presence in Mali and Uganda, as well as extend its operations to more African markets, beginning with Ivory Coast.

“OKO has fully utilized the Orange Money platform to provide a creative and inclusive service,” says Aicha Touré, CEO of Orange Money in Mali.

“With an estimated 33 million farms, agriculture is by far the most common source of employment in Africa. Despite this, farmers are denied access to basic financial services such as insurance and loans, according to Simon Schwall, the founder of OKO. “We are using technology to address this problem and ensure farmers’ income.”

In Mali, the business already has over 7,000 paying customers and compensated over 1,000 farmers who were harmed by floods last year. Customers who grow maize, cotton, sesame, or millet are usually OKO customers.

“OKO has fully utilized the Orange Money platform to provide an innovative and inclusive service,” says Aicha Touré, CEO of Orange Money in Mali.

OKO partners with agro-industries to help them achieve their sustainability objectives and maintain their supplier relationships. In Uganda, successful pilots with ABInBev and Touton were completed.

“We expect that recent advances in IoT and data availability will contribute to the growth of parametric insurance in Africa, which will help local communities. Simon and his team have established strong foundations in Mali, allowing OKO to grow into new markets and offer new insurance products.” According to Augustin Sayer, a partner at Newfund.

Farmers only need a phone (no smartphone required) to connect to OKO: they can dial a short code to get more details and pay using mobile money services.

The business works with mobile operators to achieve this degree of accessibility.

OKO prides itself on being the most comprehensive crop insurance on the market.

Read more on Tech Gist Africa:

Founders Factory Africa and Small Foundation have partnered to invest in Agritech startups