The UK will launch a new initiative to invest £375 million in UK tech startups, with taxpayers holding shares in several firms.

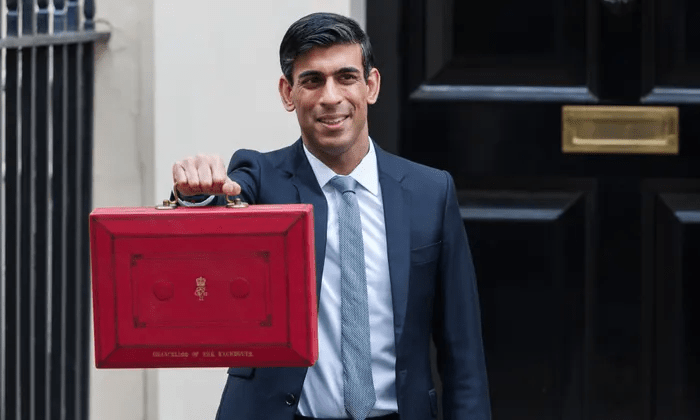

Rishi Sunak, Britain’s finance minister, is expected to announce a new fund to invest £375 million in UK technology firms, enabling taxpayers to own stakes in several UK tech startups.

According to the Financial Times, the new plan, called Future Fund: Breakthrough.

Mr Sunak has already confirmed that the tech sector will be a big focus of the upcoming budget.

“Now that we’ve departed the EU and regained control of our borders, we want to ensure that our immigration system assists companies in recruiting the best talent from around the world,” Mr Sunak said.

Mr Sunak’s strategy to make post-Brexit Britain “the most transparent and dynamic place in the world to run a financial services business,” according to the Treasury, involves enhancing the UK’s FinTech capabilities.

Mr Sunak said on Friday, following the publication of the study, that “FinTech is one of the UK’s great success stories and will help us seize new opportunities around the world.”

“We must now build on our global reputation for promoting creative start-ups by ensuring that startups in the UK have access to the talent, funding, and resources they need to scale up.”

Meanwhile, the latest and distinct Future Fund: Breakthrough will concentrate on later-stage businesses, with each contribution totaling tens of millions of pounds, matched by private sector funds.

Mr Sunak aims to increase the UK’s FinTech market share, which currently stands at 10% globally.

Read More on Tech Gist Africa;

The UK Nigeria Tech Hub launches iNOVO, a Startup Accelerator program for innovative Nigerians.

UK-Nigeria Tech Hub is partnering with Decagon for its developer placement programme

Tanzanian startup NALA is launching a money transfer app in the UK.

The UK-Nigeria Tech Hub is partnering with Dufuna for its Design School Program.