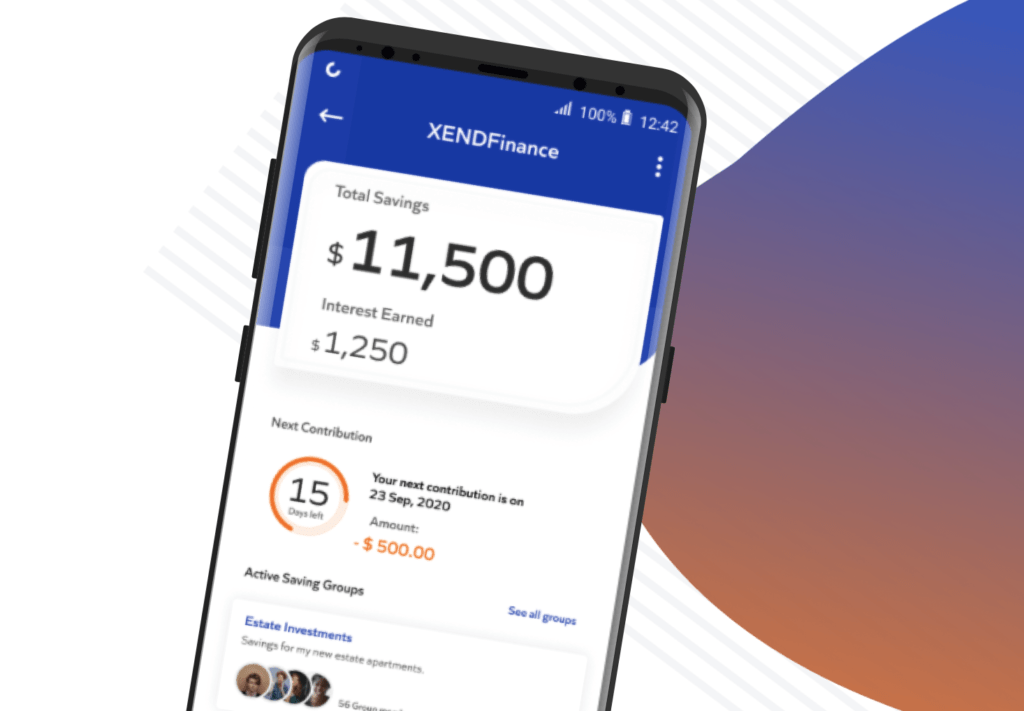

Xend Finance a Nigeria-based decentralized finance (DeFi) platform has launched its mainnet, allowing users to pool capital for the creation of their own credit unions.

According to a press release by the company, Xend Finance is a decentralized credit union protocol designed to “optimize” and “add value to the core operations” of credit unions.

The company is backed by Binance, Google Launchpad, and others.

According to a press release by the company, it’s also the first DeFi protocol to launch from the African continent using the Binance Smart Chain (BSC) network, with the aim of making financial markets more available to underserved populations.

“The issue for people of many African countries is that their currency valuations fluctuate wildly, sometimes devaluing significantly in comparison to other regions,” CEO Ugochukwu Aronu said.

“People can channel their savings into stable currencies using our platform and Binance Smart Chain, without worrying about their money depreciating overnight.”

Users may receive an annual percentage of their savings in personal or credit union accounts provided by the protocol.

Interest can be obtained by converting cryptocurrency or fiat currency to stablecoins for staking – committing assets for a period of time to engage in transaction validation on a “proof-of-stake” network.

Coupled with the launch of its mainnet, the platform will launch its $XEND token via a token generation event run by automated market maker Balancer.

Read More on Tech Gist Africa:

Termii, a Nigerian CPaaS startup, has raised $1.4 million in seed funding