Chaka, a Nigerian fintech startup, has secured a pre-seed funding round of US$1.5 million in order to expand its footprint to other West African markets.

Breyer Capital led the round of funding, Future Africa, Golden Palm Investments, Seedstars, Musha Ventures, and 4DX Ventures are among the other investors in the round.

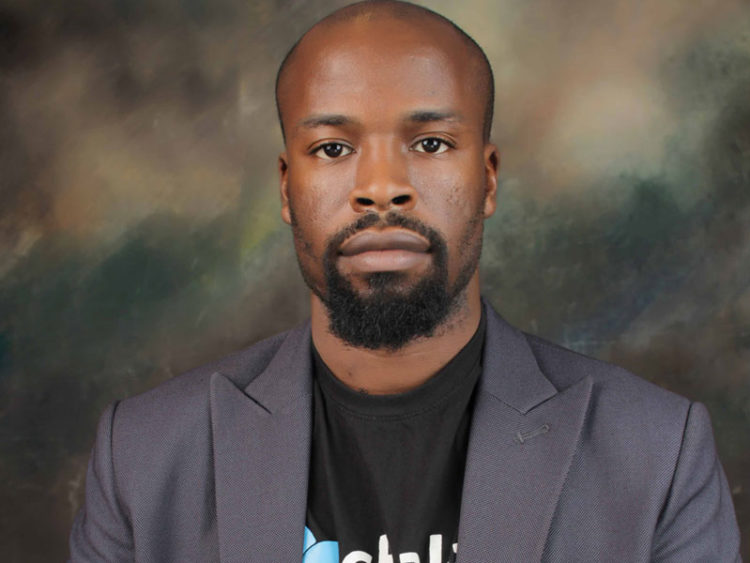

Founded in 2019 by Tosin Osibodu, Chaka is a platform that delivers tech services, marketing, customer service, and operations to brokers on behalf of their consumers.

In June, the startup received Nigeria’s first digital stock trading license, allowing it to deal with numerous stockbrokers.

It is fully approved by the SEC and gives unlimited access to over 4,000 stocks trading on capital markets.

“For us at Chaka, this is a big turning point. Tosin Osibodu, co-founder and chief executive officer of Chaka, said, “We see digital investments as a potential to support economic development in Africa, and our goal is to use this funding to bring this vision to life.”

Breyer Capital CEO Jim Breyer affirmed his belief in Chaka’s mission. “We are happy to partner with a company that is leveling the playing field for Nigerian investors”. We believe in the value Chaka provides through its digital tools, and we’re excited to help the Chaka team.

Chaka will be able to continue its mission of enabling borderless investments across Africa and providing digital investment solutions for African businesses thanks to the funds.

It will also be used to expand the startup’s footprint in West Africa in order to reach out to more individual investors and attract more foreign investors to the African capital markets.

Read more on Tech Gist Africa:

Serena Williams invests in Esusu in a $10 million Series A round led by Motley Fool Ventures.

Lidya, a Nigerian fintech stratup, has raised $8.3 million to expand its operations

FairMoney, a Nigerian fintech startup, has raised $42 million in a Series B funding round.