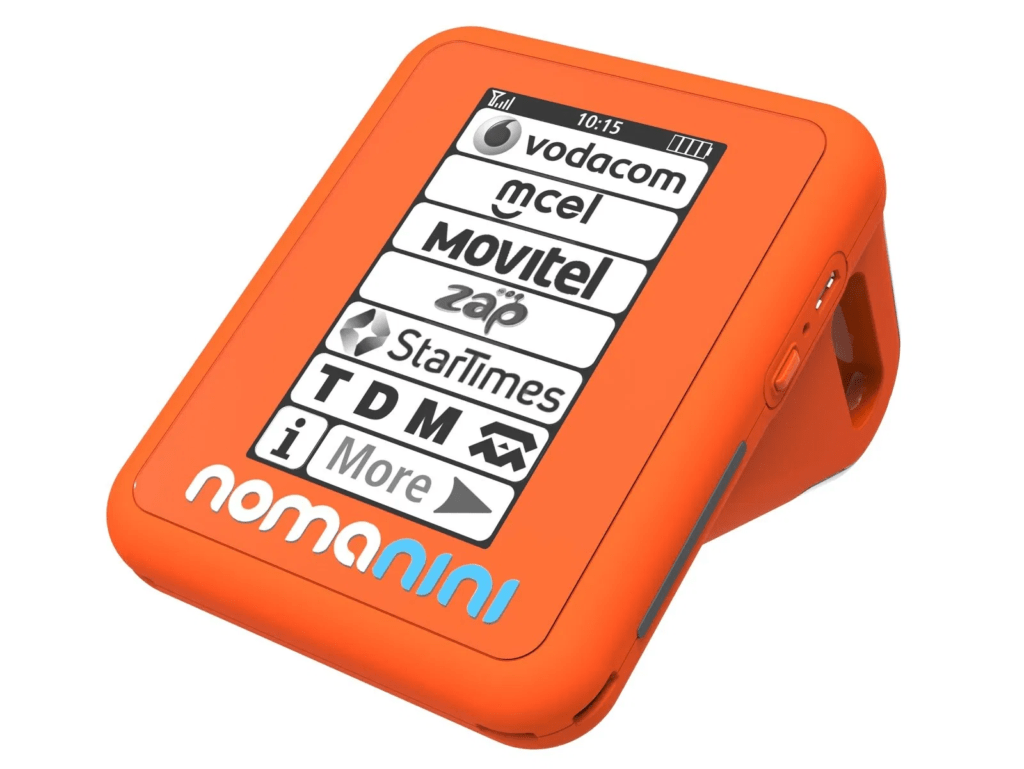

Nomanini, a South African fintech company that allows informal merchants and micro-entrepreneurs in emerging markets to sell digital products like airtime and prepaid electricity, has raised US$1.5 million in new funding from new and existing investors to expand its team, invest in product growth, and scale its offering.

In 2019, the startup, which also provides merchants with microloans and operates in Ghana and Mozambique, raised a US$4 million funding round.

Nomanini has more than doubled the number of merchants on its platform and quadrupled the number of loans in the last year, showing the significant demand for financial services and supply chain funding in this historically underserved market.

The business is now concentrating on forming new alliances and expanding its products for both financial services and fast-moving consumer goods companies.

Nomanini’s chief executive officer (CEO), Vahid Monadjem, said, “We continue to place the livelihoods of MSME retailers at the core of our focus.”

Nomanini has more than doubled the number of merchants on its platform and quadrupled the number of loans in the last year, showing the significant demand for financial services and supply chain funding in this historically underserved market.

The business is now concentrating on forming new alliances and expanding its products for both financial services and fast-moving consumer goods companies.

Nomanini’s chief executive officer (CEO), Vahid Monadjem, said, “We continue to place the livelihoods of MSME retailers at the core of our focus.”

Read More on Tech Gist Africa:

South African Fintech startup Stitch, announces $4 million seed round

South Africa’s digital bank TymeBank raises $109 million, plans Asian market expansion

Nomanini gets funding From FMO to Boost Pan-African expansion