Carbon has finally expanded its fintech offerings to Kenya. The platform is looking to offer loans and other fintech services to Kenyan citizens.

https://twitter.com/getcarbonKE

Earlier in September, we wrote that Carbon was planning to expand to Kenya as announced via its CEO Chijoke Dozie. He took to his Twitter account to announce their need for a Country Manager in Kenya.

Now in Kenya, Carbon is in strategic partnerships with Kenya-based firms like; Transunion CRB, payment platforms and MPesa. It will leverage its presence to provide Kenyans with Ksh 500 (about N1800) to Ksh 50,000 (N180,000) loans.

See Also: Nigeria-based Carbon Expands to Kenya, Deepens Offerings with Micro Health insurance

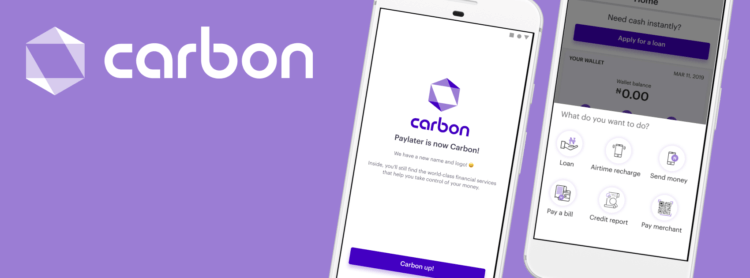

Founded in 2012, as Paylater, Carbon initially offered only instant loans to its clients. However, it later rebranded to a financial technology services platform. Its service offerings include digital wallet, bill payments, fund transfers, and savings services.

Carbon said they choose Kenya because of its regulatory environment and high levels of financial inclusion.

According to Chijioke Dozie, CEO and co-founder of Carbon, “This expansion presents an opportunity to bring some learnings from other African successful Fintech markets to Kenya. It also enables us to explore what has made the Kenyan financial services industry so successful and how this success can be replicated in other markets.”

The platform will provide services for SMEs and also offer free credit reports to Kenyan customers.

More on TechGist Africa

- Flutterwave, Carbon, 54gene and others Win 2019 AppsAfrica Innovation Awards

- Carbon, Nigeria-based Fintech Opens its API to SMEs across Africa

- Facebook Soon to Launch its Own Operating System

- TerraPay Partners UBA Group to Offer Real-time Money Transfer

- SafeBoda Launches Food Delivery Service in Latest App Update