Google, the world’s search engine giant has introduced a new policy that prohibits short term money lending Mobile Apps from Google play store. The decision was in a bid to increase reliable apps on Google’s platform while curbing user exposure to deceptive and harmful loan apps.

The new policy categorized as the Personal loan law enunciated that any loans that require full repayment in 60 days or tagged short term will have its apps cut off from Google Play Store. The law will also inhibit apps providing short-term peer-to-peer and title Mobile loans. Notwithstanding this policy, apps that offer mortgage, car, student or lines of credit loans are exempted from the ban.

See also: Google’s New Policy Bans Ads Promoting Speculative and Experimental Medical Treatment

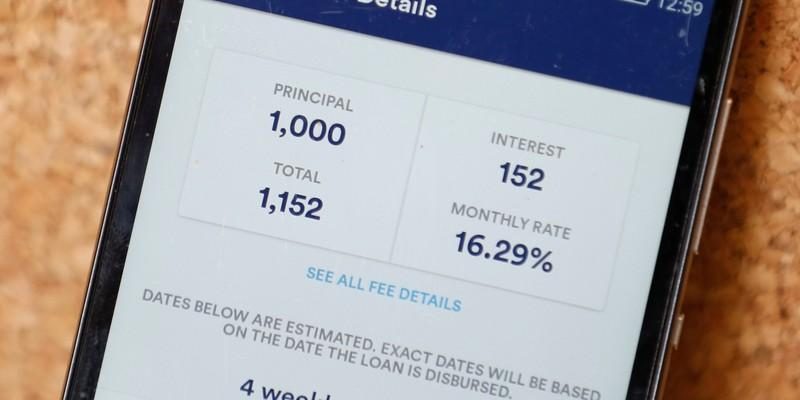

The tech giant also stated in the reviewed law that Personal loan apps on the platform must disclose information of users’ minimum & maximum period of repayment, and the maximum Annual Percentage Rate (APR). This includes interest rate, costs per year, a representative example of the total cost of loans, and all its applicable fees in the app metadata (set of data that describes and gives information about other data).

The new policy also binds on apps that offer loans directly, lead generators and those connecting consumers with third-party lenders. It puts a ban on apps that offers personal loans with an Annual Percentage Rate higher than 36% in the US. It also includes the prohibition of cryptocurrency and block-chain apps on the Store.

More on TechGist Africa:

- Uber to Launch Uber Bus in Lagos, Nigeria

- Egypt-based Doctoorum secures undisclosed Funding

- Alibaba partners Rwanda to Launch a 4-year eCommerce Training for Rwandan students

- Ogun State Launches Ogun Tech Hub to Boost Local Innovation in Nigeria

- ABAN & Afrilabs collaborates to Launch Catalyst for African Startups