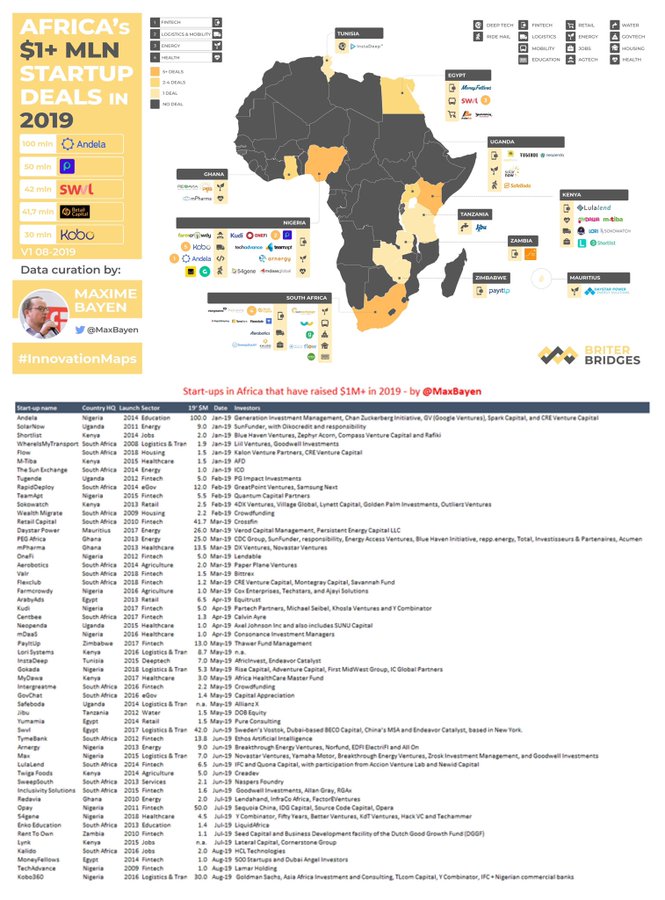

A data curated by Maxime Bayen titled ‘54 startups in Africa that have raised $1m+ in 2019’, shows that 54 African startups were able to keep afloat and receive funding from Angel Investors.

According to Maxime Bayen’s report, 2019 has brought a new dawn for the African startups who secured over $400 million funds from Angel investors. The continent also witnessed the launch of new businesses while experiencing the growth of small startups through funding.

In this third quarter of 2019, 54 African startups each secured over $1million funds from different investors. The investments in Nigerian startups amounted to more than $224.3 million while South African based startups raised the sum of 97.3 million.

Prominent on the list were South African startups with 15 fintech businesses, 10 Nigerian startups, and 8 Kenyan startups. Other startups from Tunisia, Egypt, Zambia, and Ghana were also listed.

A general factor that contributed to the sustenance of these startups was the funds secured from foreign investors and through participation in accelerator programmes.

Andela, a tech startup that develops software and train developers for companies, topped the list with the $100 million funds it acquired from Chan Zuckerberg Initiative, Gv (Google Venture), and CRE Venture Capital. Other startups that got significant funding include, TeamApt which secured 5 million funds in February, Opay secured $50 million in July and Kobo360’s $30million in August. Onefi, FarmCrowdy, Kudi, MDaas, Gokada, Arnergy, Max, 54gene, and Tech Advance, also made the list of startups that secured funds this year.

See also: Startup Spotlight: Meet SWVL the Bus Transport Disruptor in Africa

Also listed was the Egypt-based ride-hailing company Swvl which raised $42 million, South Africa based Retail Capital secured $41.7 million, and Tunisia-based InstaDeep raised $7 million. Other startups and the amount they raised were also included on the list.

The increased adoption of technology in the financial space reflected in Maxine’s list, as fintech companies accounted for 34% of the investment at $156.4million. This was followed by the logistics and transport sector with 13% at $94.9 million, Energy’s 11.1% at $72 million, and health tech 11.1resulting to $24.5 million. Jobs sat at $4 million while agritech $8 million was at 5.6%.

A major highlight on the list was the inclusion of 8 companies founded by women. This greatly reflects women’s inclusion in the tech space and their ability to create profitable businesses.

The African market is still open for investment. Africa has a history of having a large market size and enormous population. The rate at which startups are developing innovative solution shows the rapid adoption of technology in Africa. These startups are commanding the attention of investors and are working hard to scale globally. As the third quarter winds up, there is a call for more Angel investors to fund startups and help African ventures thrive.

Comparing YOY Investment figures for African startups in 2018 and 2019

When compared with the figures from WeeTracker report, the statistics show that there was a greater increase in the funds raised in 2019 as compared to 2018. In 2018, only 28 African startups raised $1 million out of the $168,6 million acquired all-year-round compared to the 54 startups which secured over $400m fund as at the third quarter of 2019.

African startups have continued to experience Year on Year (YOY) growth in investment, varying from the $185.7mn acquired in 2016, $167.7mn in 2017, $168.6mn in 2018 to the recently combined 493.3million fund secured as at the third quarter of 2019.

Interestingly, startups in the Fintech sector have continued to take the lead in securing funds YoY. These startups controlled 18% of the total sum in 2017, 40% in 2018 and 34% of the funds secured in the Maxime Bayen’s compiled list of Q3 2019. Agric, healthcare, and transport startups, amidst others, are also finding their luck with investors.

The African market is still open for investment. Africa has a long history of having a large market size and enormous population. The rate at which startups are developing innovative solutions shows the rapid adoption of technology in Africa. These startups are commanding the attention of investors and are working hard to scale globally. As the third quarter winds up, there is a call for more Angel investors to fund startups and help African ventures thrive.