Nigeria online lending platform that provides short-term loans, Paylater has announced that it has hit N4bn in loans this year, beating 2017 record by some margin.

This was confirmed in a statement released on Twitter by One Finance & Investments Ltd.’s Chief Finance Officer, Ngozi Dozie who is the founder of Paylater.

How do we startups frame it again – super-pleased, pumped? I forget.

Sha @paylaterNG has hit N4bn in loans this year, beating our 2017 record by some margin. Have a big goal for 2018 – but more on that later. Kudos to the team. @ChijiokeD @epmordi #FinancialInclusion

— Ngozi Dozie (@ngozidozie) June 19, 2018

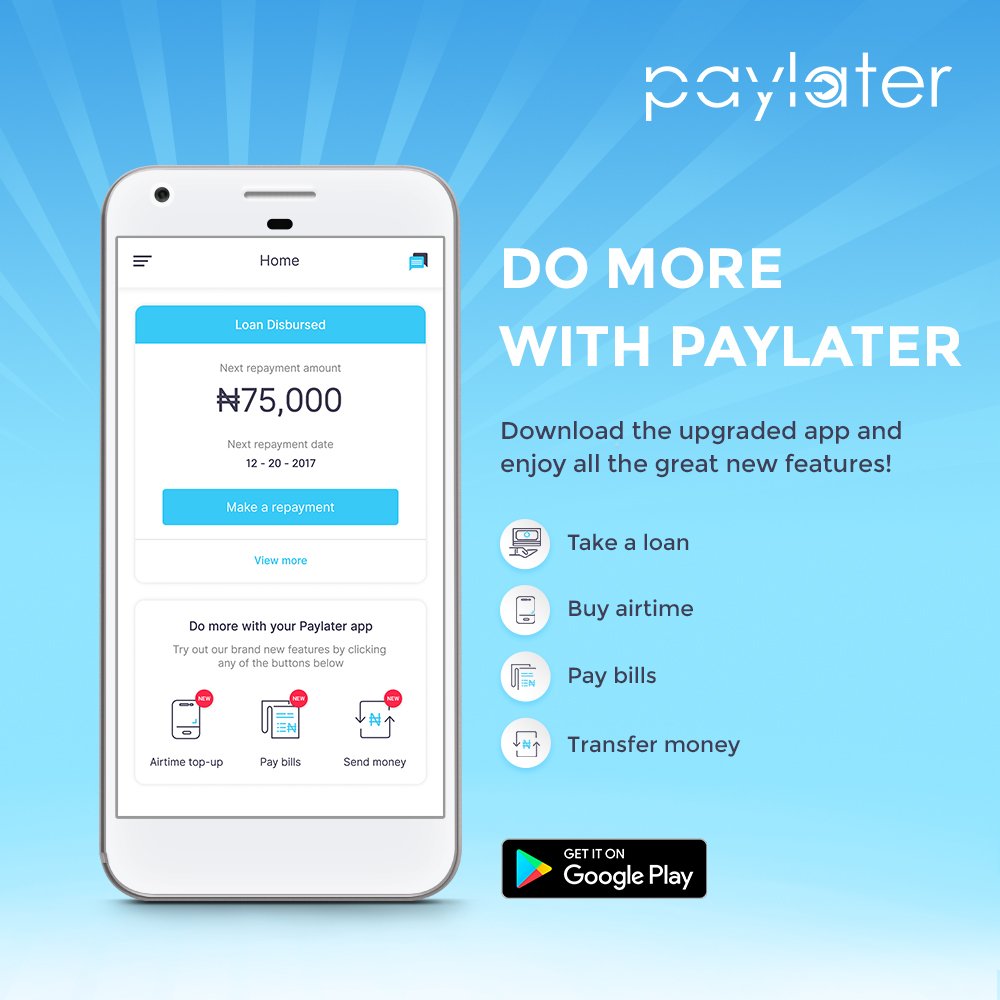

Paylater is a simple, entirely online lending platform that provides short-term loans to help cover unexpected expenses or urgent cash needs.

With just an Android device and basic requirements, you can apply for a Paylater loan 24 hours a day, 7 days a week with a quick application process that lets you know your status within minutes.No collateral, guarantors or application fees required. Just a few clicks of a button.

Earlier on in the year, Paylater launched a first-of-its-kind digital savings & loan product which will offer their customers the opportunity to save for targeted goals and earn high-interest rates whilst unlocking smaller loans at lower rates.

Paylater mobile app joined the consumer finance revolution in Nigeria with the use of Machine Learning to score customers in real time. OneFi is now said to be the leading digital bank in West Africa offering its underbanked and unbanked customers in Nigeria and Ghana access to loans and payment services.