Nigerian loan rendering startup, Paylater has launched a new feature to its services called PayVest, a fixed-interest investment product that allows users “invest” for interest rates of up to 15%. The service aims to help the company’s customers get better at managing their finances.

The company in a statement said “over the last 2 years, our app’s features have helped customers support families, grow businesses, and pay for services, whenever required.

We've just updated the app, with our fantastic new investment feature called PayVest! 🚀

Here's what's on offer:

– Earn great investment returns, up to 15.5% annually 📈

– Create up to 5 investment plans 🔀

– Zero fees/hidden charges ⛔️Available now. https://t.co/gJkK4wOwBf pic.twitter.com/c6ILzAd1It

— Carbon (@get_carbon) July 4, 2018

While these are all great for the ‘here and now’ situations, we recognize that, sometimes, you also need to plan well into the future and better control your financial flows by putting away money.”

With a two-year experience in providing loans and other services, the company realized that “sometimes, you also need to plan well into the future and better control your financial flows by putting away money.”

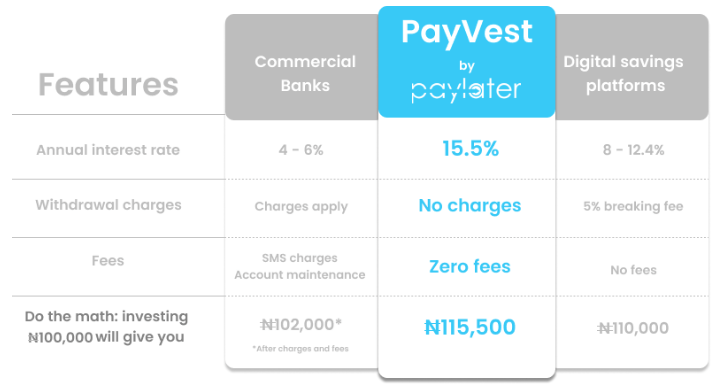

The new feature is a fixed-interest investment account for Paylater.ng users. With PayVest, users can save, or rather invest, some portion of their earnings and expect high returns later. PayVest appears to be an attractive investment option.

The feature promises an annual interest rate of 15.5%. This is a huge figure, relative to that offered by banks and means that you can earn above the inflation rate.

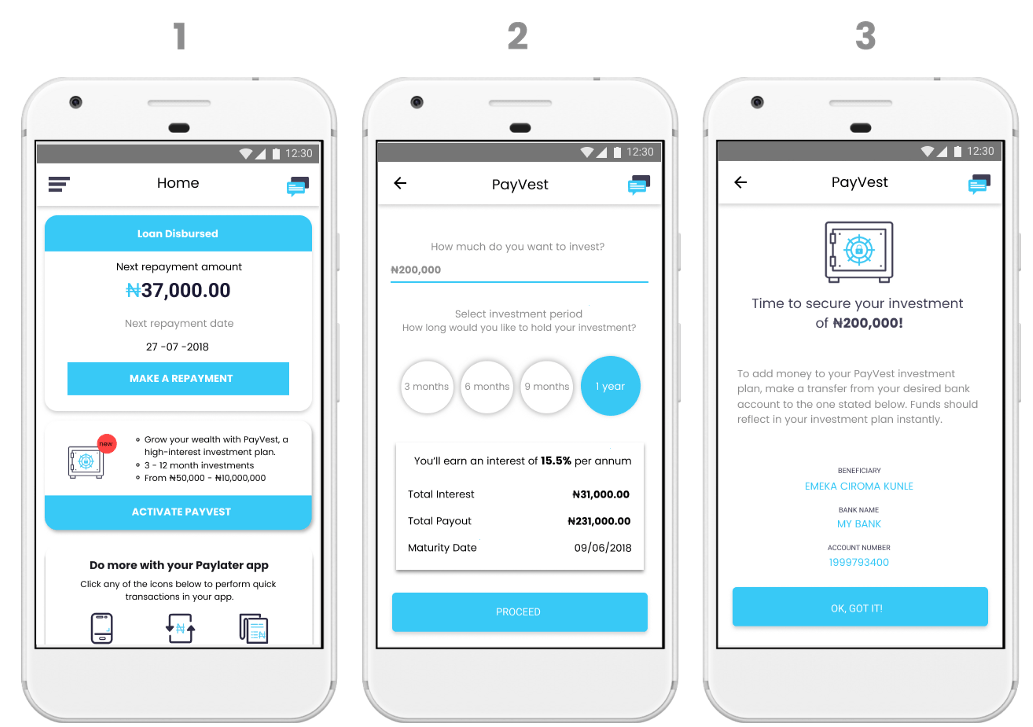

How to Set up a PayVest Account

- Download the updated Paylater app from the Google Play Store

- On the Home Page, click ‘Activate Payvest’ and enter the amount you would like to invest

- Name your investment plan (bonus points for anyone who names theirs ‘I ❤️ Paylater’!) and then confirm the terms

- We’ll provide a customized account for you to transfer your investment to, and, boom! Your investment is locked in.