Digital commerce, commonly known as e-commerce refers to the sale and purchase of goods and services online. E-commerce is one of the key drivers of economic growth in the world today with significant potential for Micro, Small, and Medium-sized Enterprises (MSMEs).

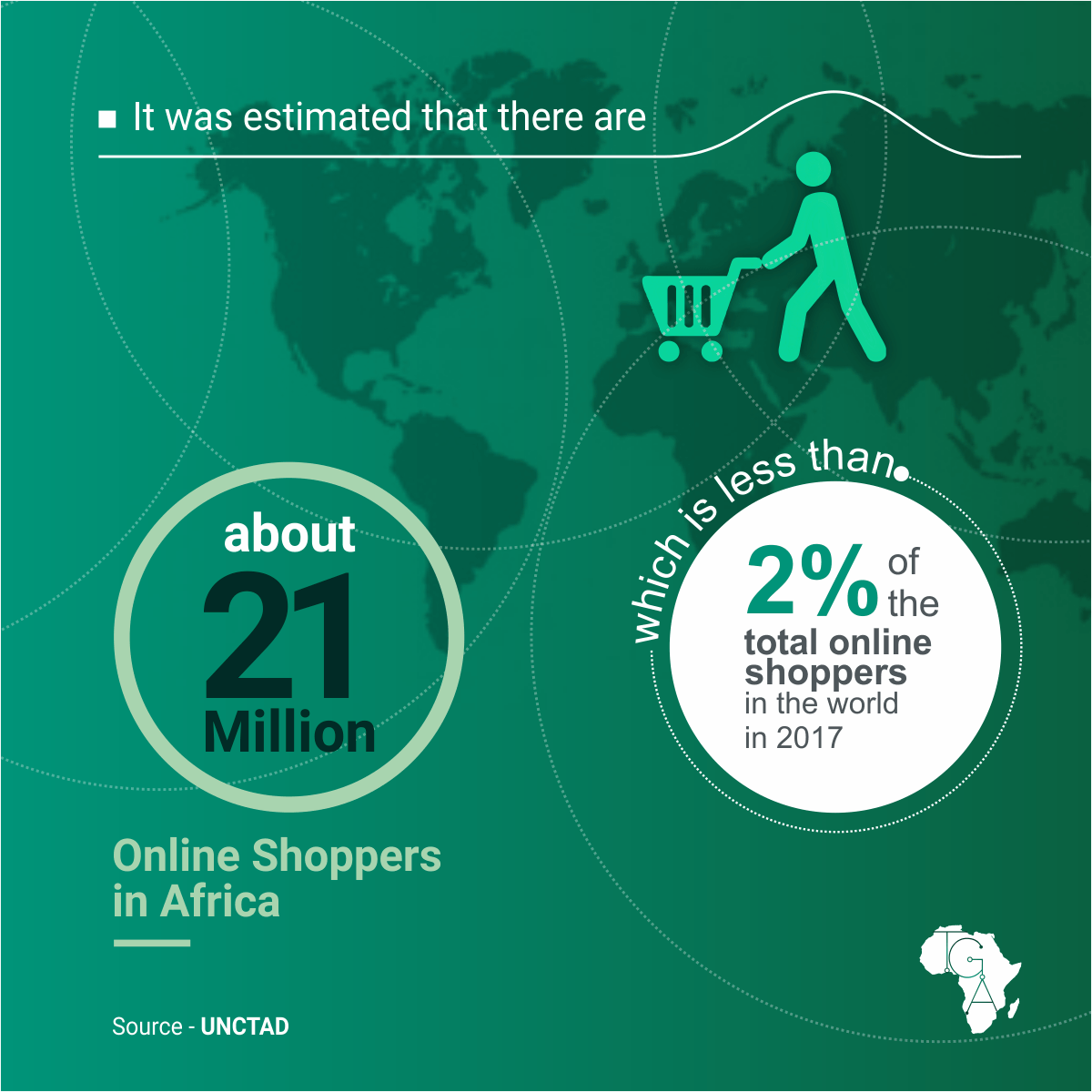

In some parts of Africa, e-commerce is still at its infancy stage compared to the US and China. According to UNCTAD, it was estimated that there were about 21 million online shoppers in Africa which is less than 2% of the total online shoppers in the world in 2017. Because of the growing rise of digital payment systems, it is certain that digital commerce will continue to grow across borders.

The MasterCard Digital Commerce Report maps out possible scenarios and steps to take in order to create an inclusive digital commerce system that opens employment opportunities for young people. E-commerce giant, Amazon for example, has become the second largest private employer in the US. China-based Alibaba group, which has tripled its workforce in the past five years has also made great impact in its expanding ecosystems. These global e-commerce giants are providing employment for millions of vendors and logistics providers, hence, digital commerce can be said to a part of the UN’s eight sustainable goal of ‘providing full employment and decent work for all’ by 2030.

See also: Mastercard, Jumia Partners to Expand e-Commerce In Africa

One of the more interesting areas in the report were the forces MasterCard cited will shape the development of digital commerce in Africa by 2030. The combination of these forces will result in an increase in the share of digital commerce. They involve the following projections:

Research by FIBR, with the support of the MasterCard Foundation, show that African MSMEs are already moving online. Micro-entrepreneurs use social media platforms, particularly Facebook, Instagram and Whatsapp to promote their services. Also, fintech platforms using USSD, mobile wallets and the likes have made remote transactions possible in some countries in Africa.

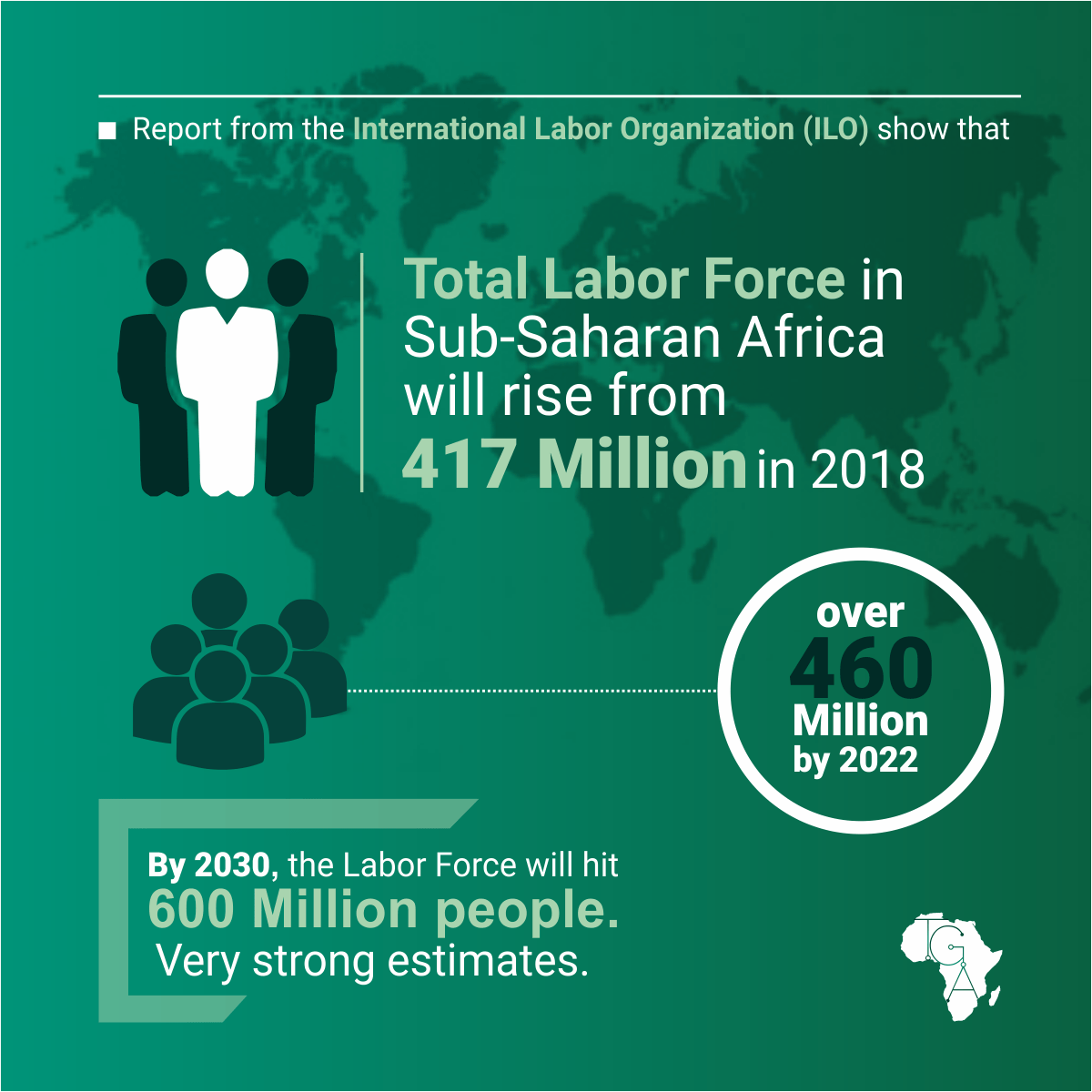

Report from the International Labor Organization (ILO) show that the total labor force in sub-Saharan Africa will rise from 417 million in 2018 to over 460 million by 2022. This means that in 2030, the labor force will be 600 million people. Very strong estimates.

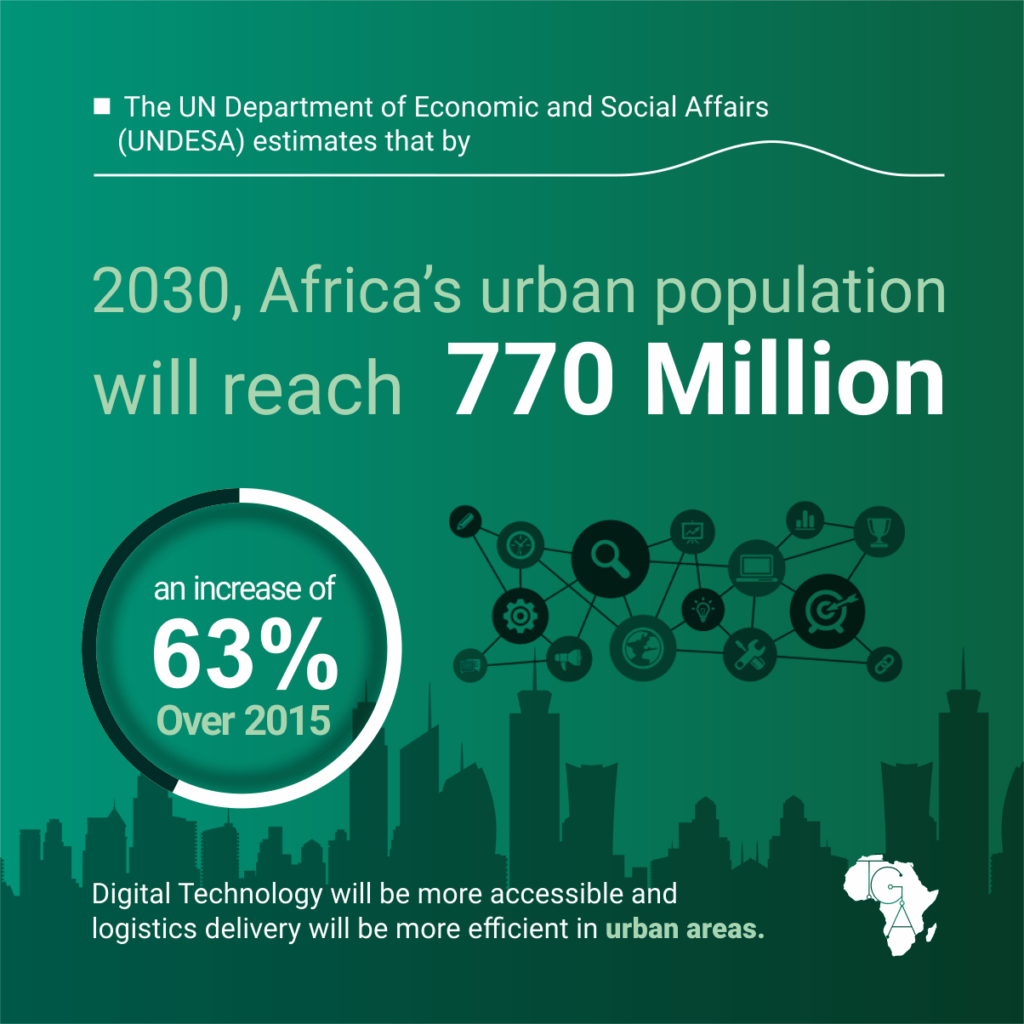

The UN Department of Economic and Social Affairs (UNDESA) estimates that by 2030, Africa’s urban population will reach 770 million, an increase of 63% over 2015. Digital technology will be more accessible and logistics delivery will be more efficient in urban areas.

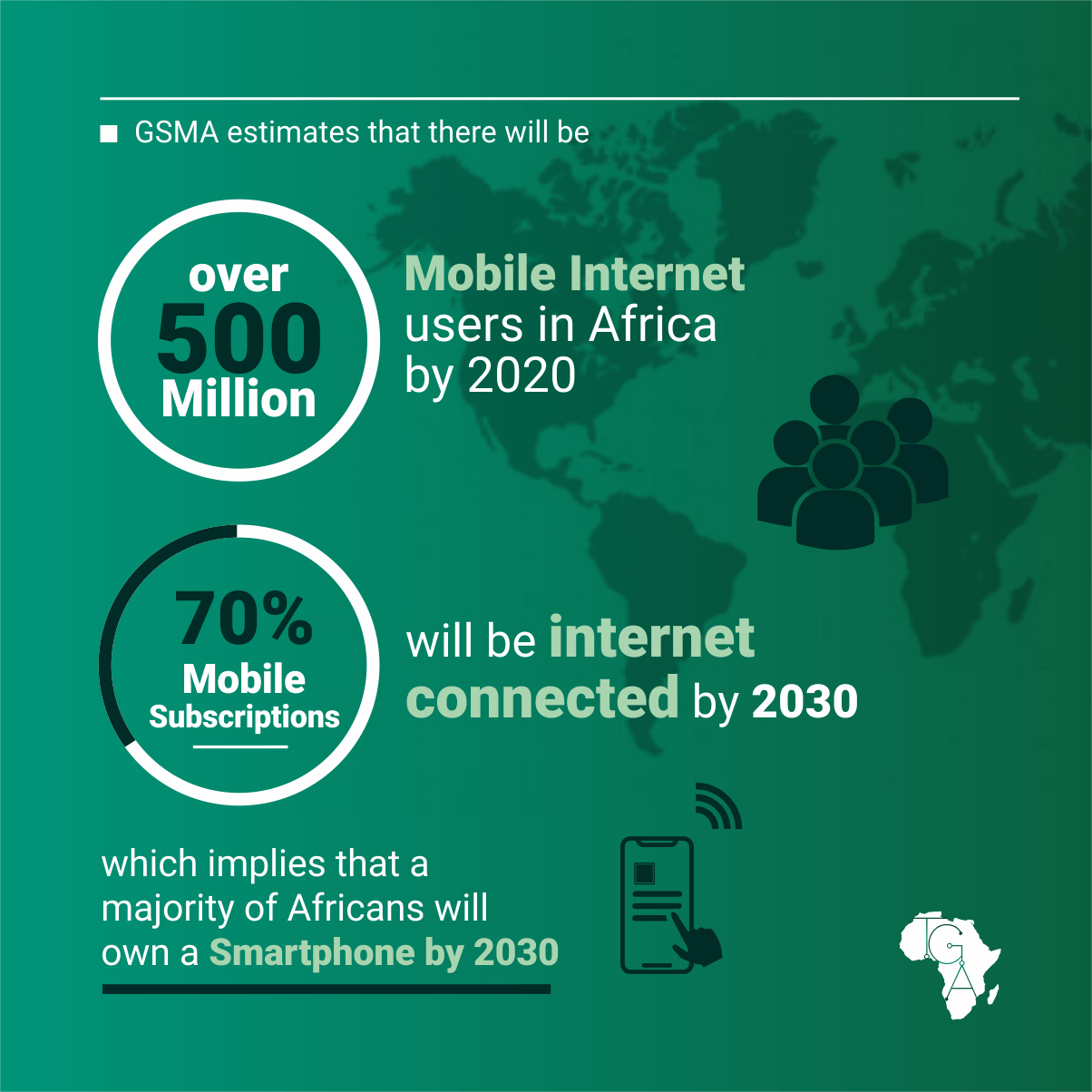

GSMA estimates that there will be over 500 million mobile internet users in Africa by 2020 and that 70 percent of mobile subscriptions will be internet-connected by 2030, which implies that a majority of Africans will own a smartphone by 2030.

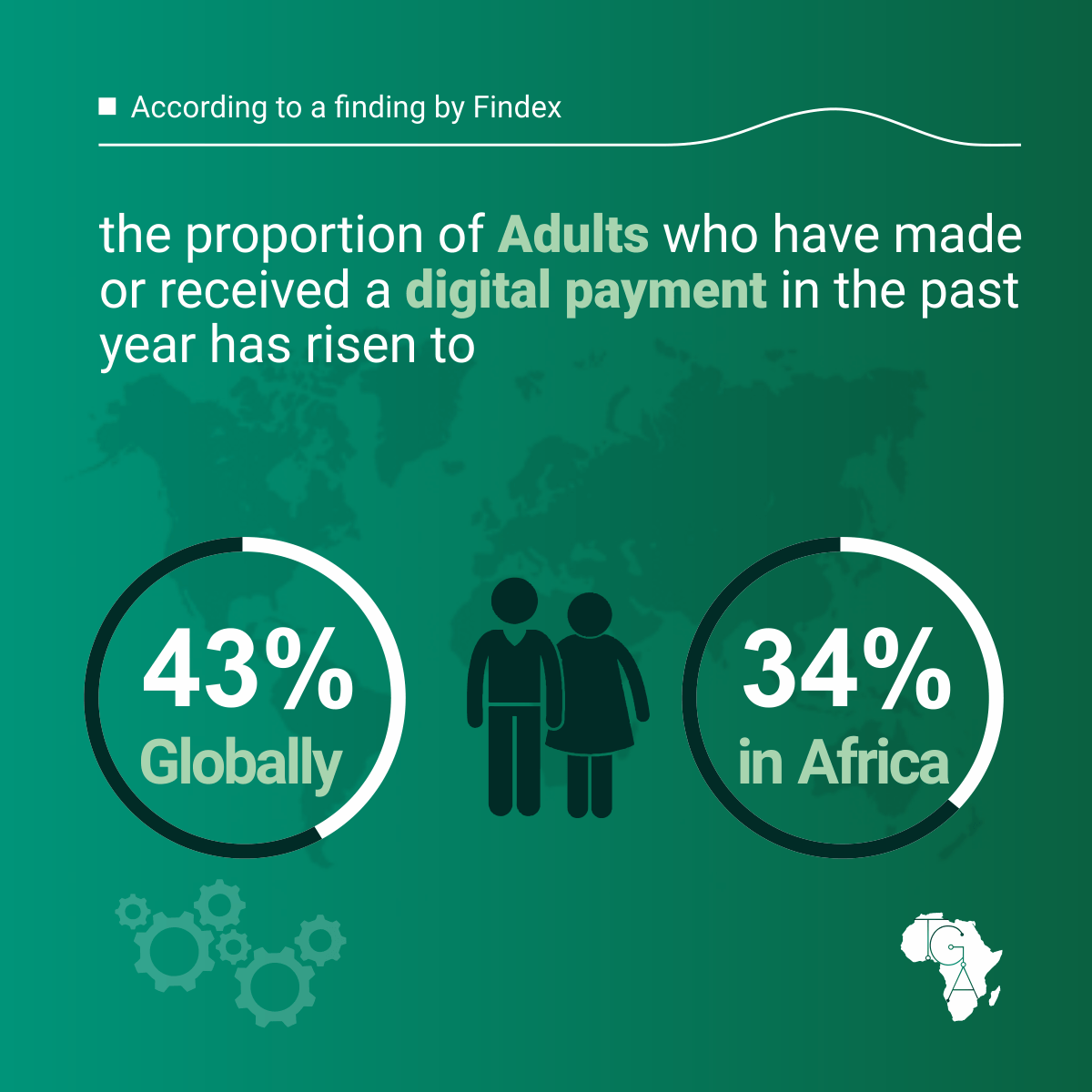

According to a finding by Findex, the proportion of adults who have made or received a digital payment in the past year has risen to 43% globally and 34% in Africa. Digital payments are the vital force that spur e-commerce.

Employments can be boosted in the expanding ecosystems forming around the Superplatforms in Africa. ‘Superplatforms’ are digital giant companies which operate multiple platforms due to their large size and financial capacity to invest in long-term research and development. In China, researchers have found that small and medium enterprises established around enterprise zones known as Taobao villages, are likely to be more developed.

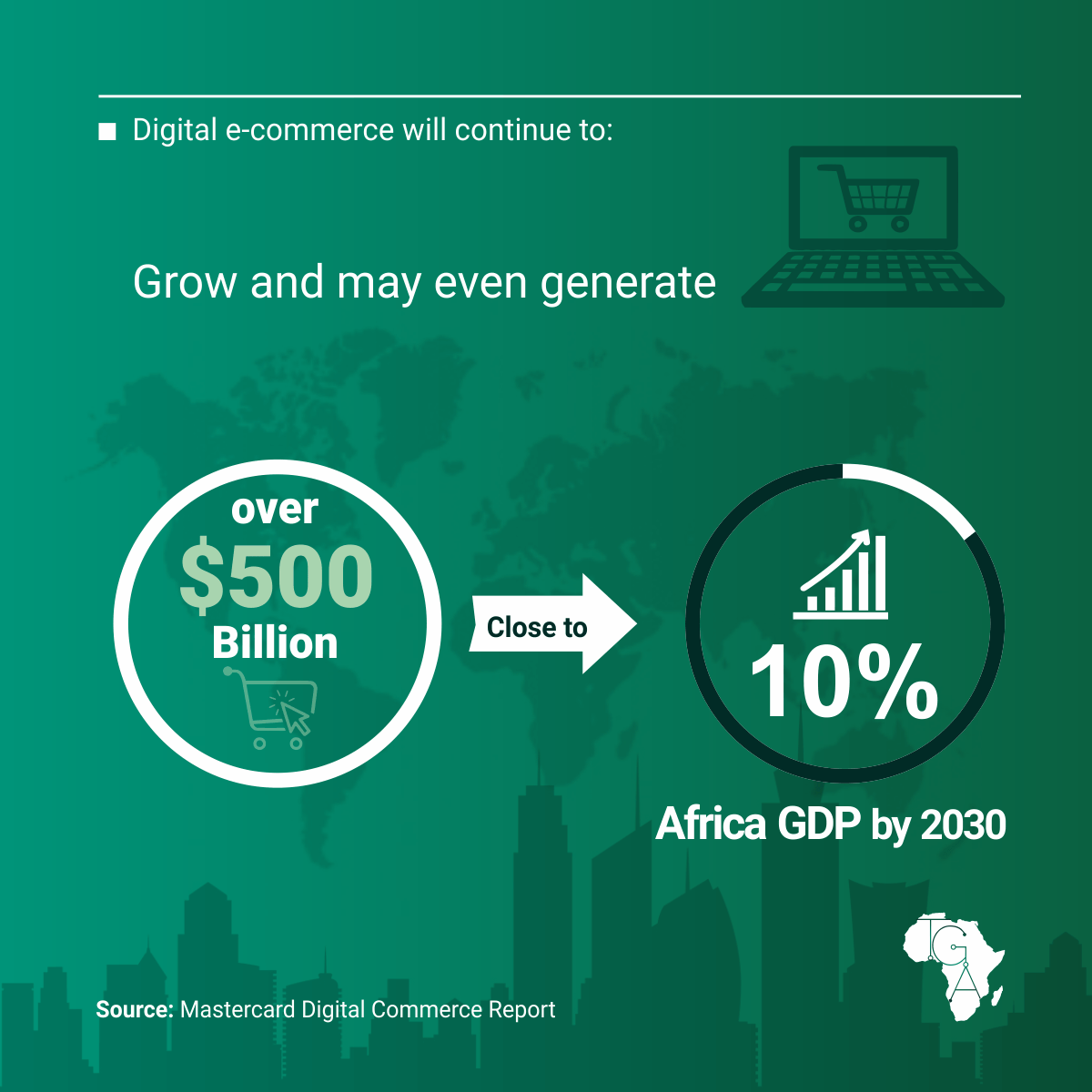

Digital e-commerce will continue to grow and may even generate more than $500 billion, close to 10% of Africa’s GDP by 2030. Reducing the barriers to entry and scale for small enterprises e-commerce can assure positive employment outcomes. Although, e-commerce is presently affected by national policies, African policymakers may be able to accelerate the growth of e-commerce even in the absence of an international agreement.

More on TechGist Africa:

- NatSave, MasterCard Partners on Zambian Digital Transaction and Financial Inclusion

- Startupbootcamp, Pride Fintech to boost 40 Egyptian Fintechs

- Visa, Branch to Expand Financial Access in Sub-Saharan Africa

- Cape Innovation & Technology Initiative Calls for Submission

- Resplash Initiative Seeks to Support Entrepreneurship In Africa