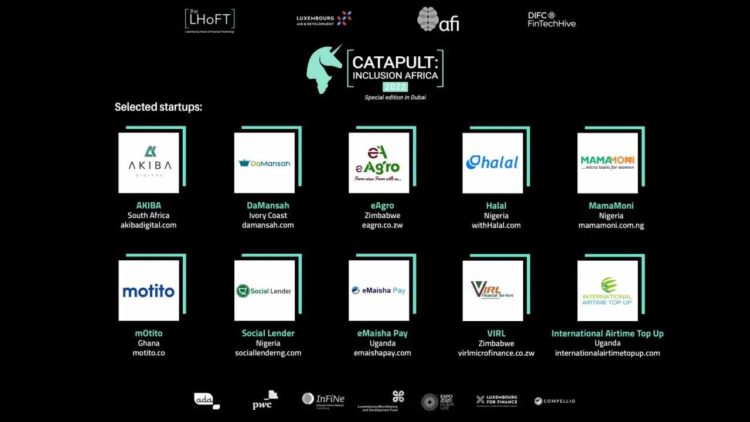

The LHoFT Foundation has selected ten fintech startups to compete in the CATAPULT: Inclusion Africa: Special Edition in Dubai in 2022.

The Luxembourg Microfinance and Fintech ecosystems will be used in this Dubai edition of CATAPULT: Inclusion Africa, with a number of mentors and specialists from Luxembourg flying to Dubai to contribute to the program.

As a demonstration of Luxembourg and the UAE’s strong partnership and collaboration, key stakeholders, partners, and mentors from the MENA area will also participate.

The Fintech Start-ups Selected For CATAPULT: Inclusion Africa:

Nigeria

- Social Lender: Helping financial institutions offer financial services based on social reputation.

- MamaMoni Limited: Microloans for low-income female entrepreneurs.

- Halal Payment: An all-inclusive digital payments service platform leveraging the Islamic banking system.

Zimbabwe

- eAgro: Using data analytics and machine learning for smallholder farmers’ financial inclusion.

- VIRL Rural & Social Financial Services: Providing loans to smallholder farmers, micro and small enterprises.

Uganda

- eMaisha Pay: Mobile platform unlocking financial opportunities for SMEs in Africa.

- International Airtime Top Up: Airtime, money transfers, and cash pick-up solutions to/from African corridors.

Ghana

- mOtito: Promoting financial inclusion and increased access to credit in Africa.

Ivory Coast

- Damansah: An alternative credit scoring infrastructure that connects credit providers to small businesses.

South Africa

- AKIBA: Alternative scoring that powers credit for small businesses and society.

Read more on Tech Gist Africa:

Twelve African startups have been selected to participate in Microsoft’s FAST startup accelerator

The Telecel accelerator has selected 11 startups for the 2nd Startupbootcamp AfriTech