Interswitch Group, a Nigerian fintech company focusing on payment digitization in Africa, has announced the launch of Quickteller Business.

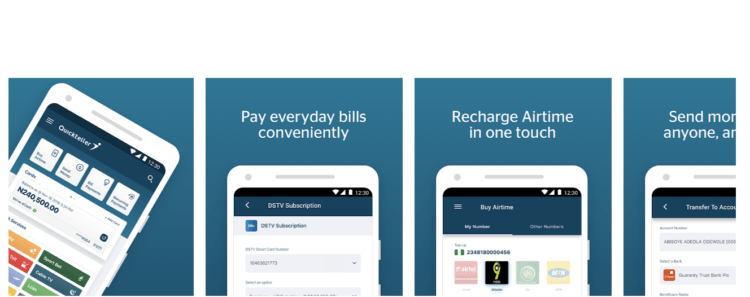

The product is a new payment and e-commerce platform.

The new product aims to support the growth of the SME sector across Africa.

Also, the product aims to expands Interswitch’s existing suite of payment solutions.

It also actively supports businesses of all sizes to facilitate payments.

Moreover, it will manage transactions from anywhere in the world through a single, simple, integrated platform.

Integrating the existing Quickteller Platform of Interswitch.

Quickteller Business will extend its payment management systems to businesses and merchants of all sizes, allowing them to do business.

More-also, The introduction of Quickteller Business to the current market platform provides a new, differentiated product.

With the ability to drive value creation for large businesses, MSMEs and consumers.

The product will leverage the substantial existing consumer base of Quickteller.

With more than five million customers currently using Quickteller for a range of retail payments in countries such as Nigeria, Kenya and Gambia.

Akeem Lawal, Divisional Chief Executive Officer, Payments Processing at Interswitch Group, said at the launch of the new platform:

“The SME sector is a potential game-changer for Africa’s economic growth and development.”

Over the last 17 years, Interswitch has been at the forefront of digital payment innovation around the world, helping citizens, companies, and governments to transact more effectively.

A major long-term change in both our market and merchant operating model is the transformation of our payment and e-commerce services into Quickteller Business.

The new platform will help African business owners thrive, providing access to reliable and easy digital payment and transaction solutions and innovations.

With the Covid-19 pandemic causing disruptions to companies of all sizes around the world.

As part of its launch deal, Quickteller Business will also offer a three-month zero transaction fee bonus for SMEs who sign up now.

Read More on Tech Gist Africa

Egypt-based Fawry Becomes Africa’s Third Unicorn to Reach a Billion-Dollar Valuation

Mono, Nigerian API fintech startup gets backing from Y Combinator