In 2012, two brothers, Chijioke Dozie and Ngozi Dozie, founded Carbon, a Nigerian digital bank start-up. Carbon began as a digital lending company, but now the company provides a variety of services, from payments to savings to investments.

According to Dozie, “Our annual report will be released in the second quarter after our financial audit is complete, to gain customer trust, Chijioke Dozie, the CEO, told ProWellTech in 2019 that the company will make Carbon’s financials public.” If you note, before we published the 2019 fiscal year update, we released a year under review in January 2020.

Gross profits, profit or loss before and after tax, liabilities and equity, total assets, etc. are included in Carbon’s annual report. Carbon’s year of analysis reveals processed payments, client base, disbursed loans, and investments made on the platform.

The business with about 659,000 customers processed N96.54 billion (~$241.35 million) according to Carbon’s year of analysis for fiscal year 2020, which is up 89 percent compared to the same period a year earlier. N25.51 billion (~$63 million) was the disbursement volume for its lending arm, an improvement of 9.1 percent from the 2019 financial year. Investments worth N13.02 billion (~32.55 million) were made on the site, up by 365 percent from FY 2019.

The factors that affected these numbers last year, according to the company, included the launch of an iOS app that pushed clients

Acquisition, introducing its feature for low-income customers with USSD banking services; and a social chat feature to allow faster transactions.

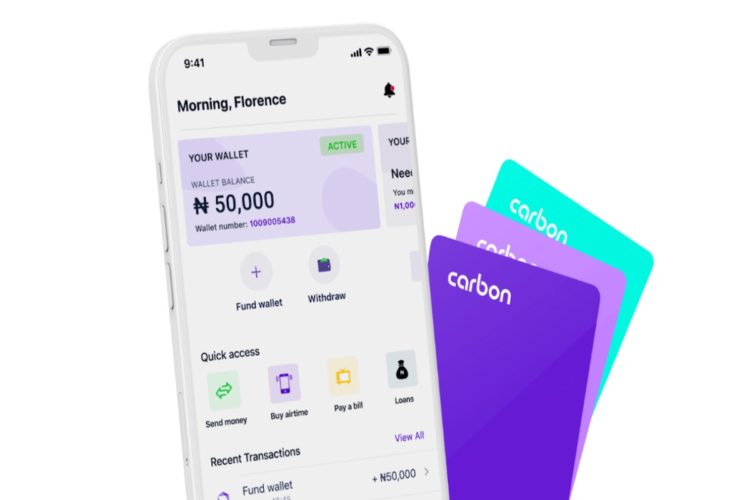

Besides that, Carbon obtained a microfinance bank license in an attempt to become a digital bank. The license implies, according to Dozie, that Carbon’s customers are given additional protection by the Nigerian Deposit Insurance Corporation through depositor insurance.

The standard Carbon wallet is now a full-fledged bank account, Dozie says, and clients will transact on the platform like any bank would.