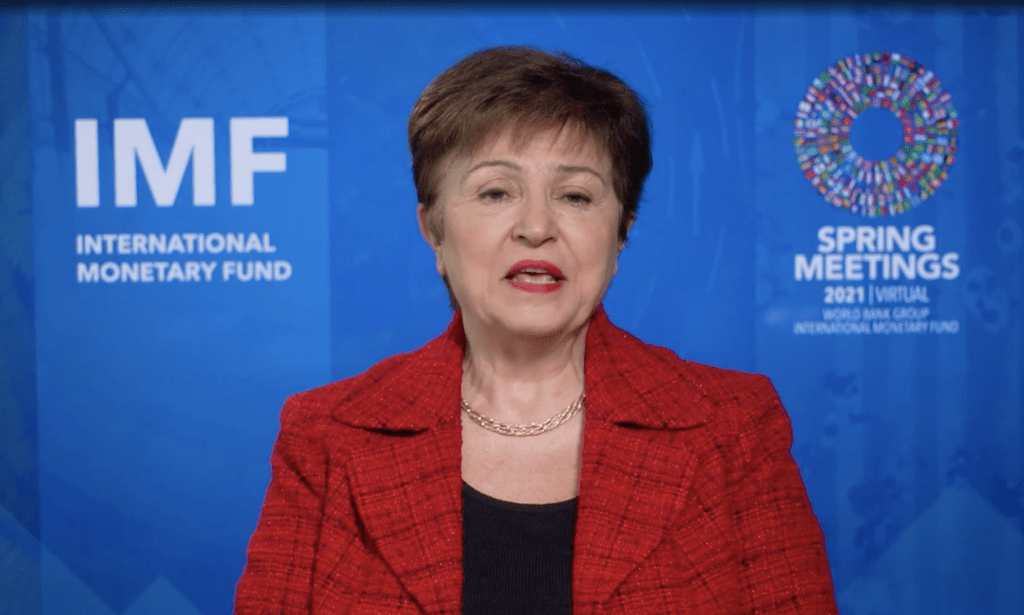

Kristalina Georgieva, the Managing Director of the International Monetary Fund (IMF), has urged governments and individuals to use digital money to make remittances and cross-border transfers “faster, simpler, and cheaper.”

This was claimed by Georgieva during a virtual workshop on how digital money can help with remittances. She spoke at length about the ability of decentralised money to boost remittance flows to developing countries and “reshape cross-border payments” at the conference.

The adoption of digital currencies as a means of sending and receiving currency, according to Georgieva, is a “revolution” that leaves many countries with little or no choice.

“The Bahamas introduced the Sand Dollar, the world’s first central bank digital currency, last year. Many other countries are looking at starting their own pilot programs. Cross-border transfers are increasingly being made with other types of digital currency, such as privately issued secure coins. “We are experiencing a digital money revolution that has the potential to make remittances simpler, quicker, and less expensive,” she said.

A cheaper remittance transfer, according to Georgieva, will aid poor households around the world in coping with the effects of COVID-19.

“As we search for solutions to the challenges of economic disparities between nations, we must use every tool at our disposal to assist those who are most affected by the pandemic. We must also ensure that all countries benefit from the latest developments in digital money and payments, especially remittances, as the risk of an increasing digital divide between rich and poor countries grows,” she said.

“With such digital disruption comes risk,” Georgieva added. We can combat the dangers of digital money by concentrating our efforts in three regions. First and foremost, modern types of money must maintain their trustworthiness. Consumers must be protected, they must be secure and grounded in sound legal systems, and they must support financial credibility.

As the world moves to a decentralized money age, she added, the IMF will give itself as a transmission line of best practices, capacity building, and policy implementation.

Video source: IMG.org

Read More on Tech Gist Africa:

European Central Bank President, Christine Lagarde calls for global regulation of bitcoin