In order to expand its activities throughout Nigeria, Kenya, and other African nations, the trade finance startup FrontEdge, based in Nigeria, has raised US$10 million in debt and equity capital.

FrontEdge assists African SMEs in transnational trade.

In a funding round that was headed by TLG Capital and also included Flexport, digital trade-finance platform FrontEdge was able to raise debt and equity to start working towards its goal.

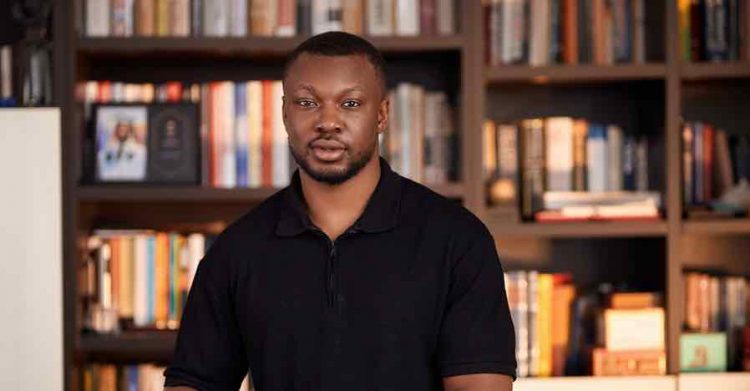

Moni Alli started Front Edge in 2021 to help importers and exporters in developing economies with working capital and digital solutions.

“SMEs are the cornerstone of our economies and the export market presents a significant opportunity for small and medium sized African businesses. However, from Lagos to Mombasa, business owners are constrained by an inability to finance their exports as well as a lack of support at every stage of the export process. FrontEdge was founded to address both challenges through a seamless technology platform tailored to cross-border traders,” said Alli.

“TLG is proud to support FrontEdge in its mission to help African SMEs prosper, serving as a crucial conduit to provide access to capital for Africa exporters and financial empowerment. FrontEdge is strategically placed to tackle an important problem that must be solved for African traders to effectively engage in global trade and we believe that the leadership will execute on the vision,” said Johnnie Puxley of TLG Capital.

By giving SME exporters and importers the resources and know-how they need to expand and compete globally, the startup hopes to support the expansion of cross-border trade throughout Africa.

Read more on Tech Gist Africa:

Pricepally, a Nigerian food e-commerce startup secures $1.3 million in seed funding

Shekel Mobility, a B2B mobility startup based in Nigeria has raised $7 million

AFEX, a startup in Nigeria specializing in commodities trading, has raised $26.5 million