Numida, a fintech firm in Uganda, has raised US$12.3 million in pre-Series A debt and equity capital to help it grow its workforce and enter new markets.

In addition to current investors MFS Africa, Breega, 4Di Capital, Launch Africa Ventures, Soma Capital, and Y Combinator also participate in the US$7.3 million equity portion of the round led by Serena Ventures. Lendable Asset Management will provide $5 million in debt to complete the round.

In 2017, Mina Shahid, Catherine Denis, and Ben Best founded Numida, which first allowed existing MFIs to offer unsecured credit to semi-formal firms. However, the company quickly changed its focus and started making direct loans to micro- and small-business borrowers.

Unsecured working capital loans are offered by Numida to African micro and small businesses using unique credit models and tech-enabled underwriting procedures (MSBs).

“Our claim to fame is that we have discovered a way to obtain and disperse unsecured working capital to cash-based enterprises without a digital transaction history. We don’t use data from digital point-of-sale systems or online marketplaces, and we don’t collect user data from their phones either. As a result, we have been able to serve the mom-and-pop stores that make up the bulk of enterprises in Africa and greatly increase our consumer base, according to Shahid.

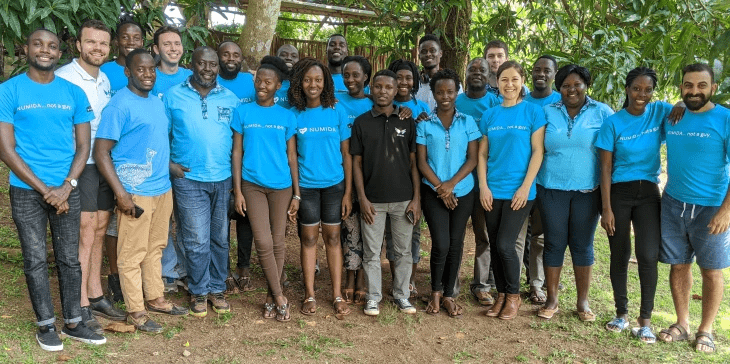

The additional funding will aid in expanding the startup’s team and enabling it to enter more markets; over the next 18 months, it expects to increase its workforce to 200 people.

Read more on Tech Gist Africa:

XENO, a Ugandan fintech startup, has raised $2 million in seed funding

Rocket Health, a Ugandan telemedicine startup, has raised $5 million in a Series A round

Asaak, a Ugandan fintech startup, has raised $30 million in pre-Series A funding.