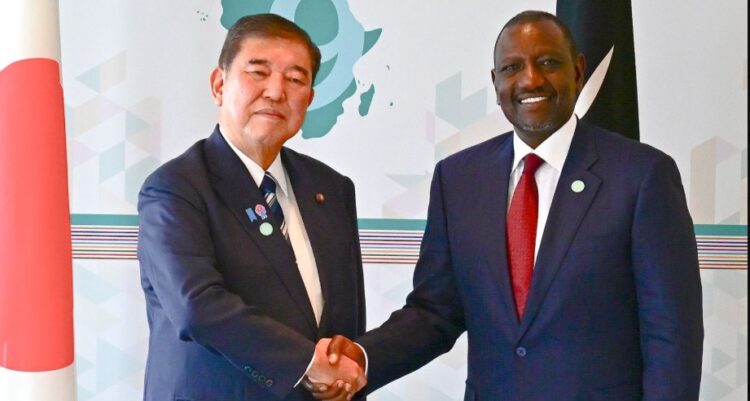

In a significant stride towards industrial advancement and energy efficiency, Kenya has secured a ¥25 billion (approximately $169 million) Samurai loan from Japan. This financing agreement was formalized during the Ninth Tokyo International Conference on African Development (TICAD 9) in Yokohama, Japan. The deal was signed by Kenyan Foreign Affairs Minister Musalia Mudavadi and Atsuo Kuroda, CEO of Nippon Export and Investment Insurance (NEXI).

Strategic Focus Areas

The funds will be allocated to two critical sectors:

- Automotive Industry Development: Strengthening Kenya’s local vehicle assembly and parts manufacturing industries. This initiative aims to reduce reliance on imported vehicles, promote job creation, and encourage the development of electric vehicle (EV) infrastructure.

- Energy Sector Enhancement: Addressing electricity transmission and distribution losses, which currently account for approximately 23% of national output. The investment will focus on upgrading grid infrastructure, implementing smart metering systems, and improving overall energy efficiency.

Financial Structure and Implications

The Samurai loan is a yen-denominated debt instrument issued in Japan, typically offering lower interest rates compared to traditional dollar-denominated loans. The backing by NEXI provides additional security, potentially reducing Kenya’s borrowing costs and mitigating currency exchange risks. This move aligns with Kenya’s broader strategy to diversify its funding sources and manage debt more effectively in the face of global market volatility and rising interest rates.

Broader Economic Strategy

Kenya’s engagement in Samurai financing reflects a strategic shift in its debt management approach. The government is exploring various financial instruments, including sustainability-linked bonds and debt swaps, to reduce the cost of borrowing and alleviate fiscal pressures. This diversified approach aims to enhance economic stability and support sustainable development goals.

The Samurai loan from Japan marks a pivotal moment in Kenya’s economic development, offering substantial support to its automotive and energy sectors. By leveraging this financing, Kenya is poised to enhance industrial capacity, improve energy efficiency, and foster sustainable economic growth. This initiative underscores the importance of international partnerships in achieving national development objectives and positioning Kenya as a leader in East Africa’s industrial and energy sectors.

Read more on Tech Gist Africa:

Ghana to Become Africa’s First AI-Powered Agricultural Hub with $100M Japanese Investment

Finnfund Invests $4M in Poa Internet to Expand Affordable Broadband in Kenya